Did you know that you can change billing dates on your credit cards to any other date of the month as per your convenience?

While it was not always possible earlier, this was enabled by RBI in their 2022 guidelines regarding Credit Cards.

As per Point 10. BILLING (f) of RBI Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022 (Updated as on March 07, 2024), “Cardholders shall be provided option to modify the billing cycle of the credit card at least once, as per cardholders’ convenience .”

In today’s post, I will be discussing about this, and let you know how you can easily modify the bill generation dates of your credit cards. Let’s get started.

Important Points:

-

Choose a date that is convenient for you. For me, 5th of any month was the most convenient, as I like to clear dues as soon as bill generates. Having my bills at the first week of any month helps me to sort my finances better.

-

Note that your chosen convenient date may not be available with the bank. So, think of an alternative date or dates close to your chosen date, as your second option. If your chosen date is not available, then you can ask them to change your credit card billing cycle to the alternative date.

-

If you are struggling to optimize your credit card spends, refer to this post for the Best Credit Card Management Apps.

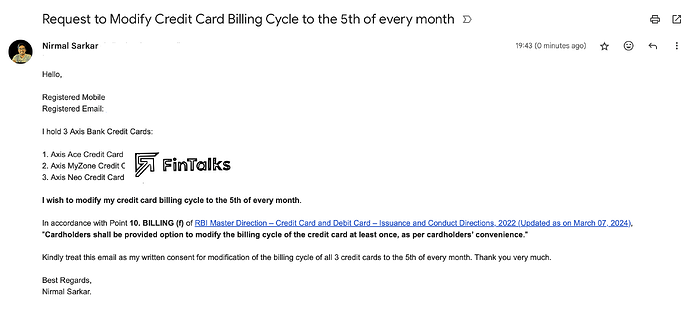

The Email Method:

This is the default method, and should work for most of the banks, but not all. Actually this saves a lot of time, as you can create a template and send email to the banks one by one, and wait for their response. Generate a template from Chatgpt with this prompt: (change the prompt as per your wish)

I want to send an email to (Credit Card Name) customer support for changing my credit card billing date to ## of the month. Write a short email template for the same.

Make sure you include the RBI rule in your email, which I mentioned in the top. If you have multiple credit cards, just mention the card number (last 4 digits) at the beginning of the email, and you are good to go.

Here’s the email I sent:

Below, I am listing down the steps to follow for each bank, after sending the email above. Check them out.

Note: Not all banks are listed below, as I do not have all bank credit cards. I only listed the banks whose cards I have and use.

American Express Credit Card:

For Amex Credit Card, you need to call the Amex Customer Support Toll Free Number, and request for the change of billing cycle. They will take your request, and do the needful within 3-5 working days.

Please note, before making the request, you need to clear all outstanding dues or pay the bill for your Amex Credit Card. Do not make any more transactions till your billing date change gets reflected within 3-5 days. This is the requirement for Amex.

AU Bank Credit Card:

I do not own AU Credit Card, so I cannot speak of my personal experience. However, I heard from my friends that AU is stubborn, and does not offer much flexibility in changing billing dates. In case you use AU Bank Credit Card, do try this method out and let me know in the comments below. I will update here.

Axis Bank Credit Card:

For Axis Bank Credit Card, once you send the email, they will either reply you back, or call you back, and tell you some specific dates that you can choose as your bill generation date. For me, they offered the dates: 1, 7, 10, 12, 13, 15, 18, 20, 22, 25. I wanted 5th of the month as billing date, but they didn’t allow that. So, I chose 1st of the month as the bill generation date.

BOB Credit Card:

For BOB Credit Card, once you send the email, they will reply you back and tell you some specific dates that you can choose as your bill generation date. For me, they offered the dates, 1, 7, 13, 16, 18, 25. I wanted 5th of the month as billing date, but they didn’t allow that. So, I chose 1st of the month as the bill generation date.

Federal Bank Credit Card:

For Federal Credit Card, you simply need to send the email. Federal Bank obliged my email request, and took the request for change in billing date to 5th of every month without any issues. They might call you once for verification purposes. In case the date you want to change is not available, they will offer you additional dates.

HDFC Bank Credit Card:

For HDFC Bank Credit Card, you only need to send the email. They were the fastest to respond after I sent them email. They initiated the change in billing cycle without any further calls or emails, within 10-12 hours of mailing them. And the request got processed within 1 working day. Very smooth service on their part.

HSBC Credit Card:

I do not have any HSBC Credit Card, so I cannot update anything on this. If you have a HSBC Credit Card, try it out and let me know about your experience in the comment below. I will update it here.

ICICI Bank Credit Card:

For ICICI Bank Credit Card, to change billing dates for your credit card, you have to do it via their iMobile App.

Open iMobile App > Dashboard > Cards/Forex/Paylater > Choose your ICICI Credit Card > Manage Card > View & Manage Billing Cycle > Desired Billing Cycle.

You can see some dates that are available there. For me it showed these dates: 2, 5, 8, 12, 14, 16, 18, 20, 25, 28. Not all dates are available. You need to choose from the dates shown there. I chose 5th of the month, which was my desired date and was available.

Note: If you have Amazon Pay ICICI Credit Card, then you need to do it separately for that card too.

IDFC First Credit Card:

For IDFC First Credit Card, once you send the email, they will call you back, and tell you some specific dates that you can choose as your bill generation date. They are not as flexible as other banks as they offered me only 4-5 options over call (hence I don’t remember the dates), however they were very closely aligned, and not well spread out over the month. For example, I wanted to change all my bill generation date to 5th of the month. IDFC customer support didn’t allow that. They offered me 1st of the month as an alternative (which was closest to the date I wanted), and I agreed.

##. IndusInd Bank Credit Card:

For IndusInd Credit Card, you just need to send the email. IndusInd obliged my email request, and took the request for change in billing date to 5th of every month without any issues. They might call you once for verification purposes. In case the date you want to change is not available, they will offer you additional dates.

Kotak Bank Credit Card:

For Kotak Credit Card, you will need to send the email. Kotak Bank will call you back once you send the email. Over the call, they will confirm and take your request for the change in the billing date. In case the date you want to change is not available, they will offer you additional dates. For me, the date I wanted (5th) was available, and hence they took the request.

OneCard Credit Card:

Onecard is the most stubborn bank in my experience, as they just offered 1 extra date (22nd) other than my current billing date (16th) in the name of RBI rule. I have declined the request as it doesn’t help me much. I wanted it on the first week of the month, and they denied. Do let me know your experience with this.

PNB Credit Card:

I do not have any PNB Credit Card, so I cannot update anything on this. If you have a PNB Credit Card, try it out and let me know about your experience in the comment below. I will update it here.

SBI Credit Card:

For SBI Credit Card, you just need to send the email. SBI obliged my email request, and took the request for change in billing date to 5th of every month without any issues. They might call you once for verification purposes. In case the date you want to change is not available, they will offer you additional dates.

Standard Chartered Credit Card:

For Standard Chartered Credit Card, you just need to send the email. SC Credit Card team obliged my email request, and took the request for change in billing date to 5th of every month without any issues. They might call you once for verification purposes. In case the date you want to change is not available, they will offer you additional dates.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.