In case you are looking forward to apply for an SBI Credit Card, then SBI SimplyClick Credit Card and SBI Cashback Credit Card are the best cards to apply. We have already talked about SBI Cashback Credit Card earlier . In today’s post, we will discuss about SBI SimplyClick Credit Card , its benefits, and how you can apply for the same. We also have a method that you can use to waive off your card fees.

SBI SimplyClick Credit Card Features:

- Earn 10 Reward Points on Apollo 24x7, BookMyShow, Cleartrip, Dominos, Eazydiner, Myntra, Netmeds & Yatra spends.

- Earn 5 Reward Points on all other online spends.

- Get a 1% Fuel Surcharge waiver for spends between ₹500 to ₹3000.

- Milestone Benefit: Spend 1 Lakh in a card membership year and get a Yatra voucher of ₹2000. Spend another 1 Lakh in the same card membership year and get another Yatra voucher of ₹2000.

- Redeem Reward Points for vouchers. 1 Reward Point = ₹0.25.

- Welcome Benefit: Get ₹500 Amazon Voucher on payment of joining fees.

Note: You need to be a minimum of 23 years old for salaried, and 25 years old for self employed, and have a monthly income of ₹25000 to apply for SBI Card.

SBI SimplyClick Credit Card Fees:

- SBI SimplyClick Credit Card comes with a joining fee of ₹500 + GST. However, you get ₹500 Amazon Voucher on paying joining fees, so it is effectively free for you.

- SBI SimplyClick Credit Card comes with an annual fee of ₹500 + GST. If you spend 1 Lakh or more in a card membership year, your annual fee will be waived off. Remember, you also earn ₹2000 Yatra voucher along with it as a milestone benefit, so its a win-win for you.

- Even if you do not achieve your annual spends of 1 Lakh with this card, you can use this method to Get your SBI Credit Card Annual Fees waived and/or Convert your SBI Credit Card to Lifetime Free . [Note that the link given above is a “Members only” post. If you see a ‘Page Note Found’ error on the above link, please log in to FinTalks Forum to view this post.]

How to Apply for SBI SimplyClick Credit Card?

- Click here to Apply for SBI SimplyClick Credit Card.

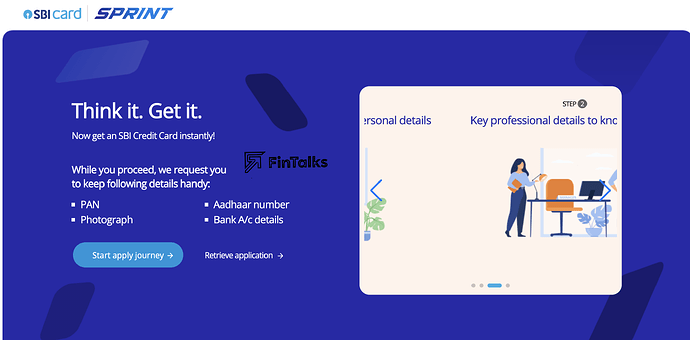

- SBI Card now gets processed via SBI Sprint portal with chances of instant approval. Click on Start Apply Journey.

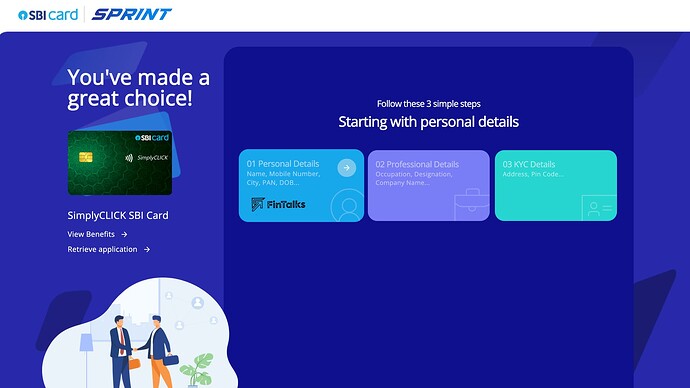

- It will show SimplyClick Credit Card. You can click on View Benefits to check the card benefits.

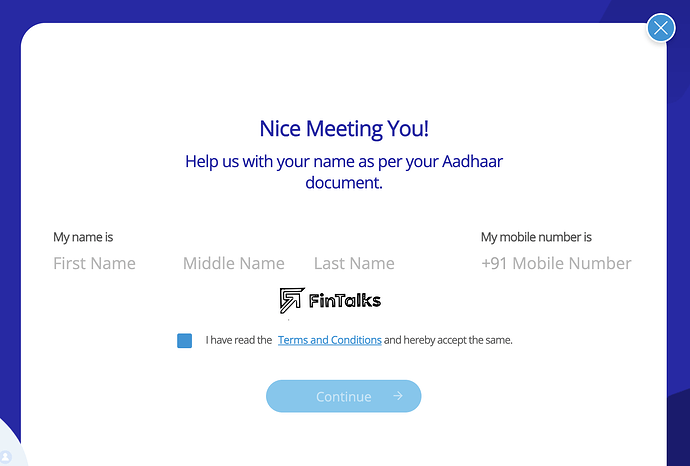

- Click on Personal Details, and enter your Name and Mobile Number.

- Click on Continue and Verify your Mobile Number with OTP.

- Next, it will ask your current residing city. Choose from the dropdown and click Confirm City.

- On the next page, it will ask your PAN Card Number, and DOB. Choose them and click Confirm.

- On the next page, enter your Mother’s name and Email ID. Click on the checkbox to confirm that you are Indian. Now, click on Continue to Step 2.

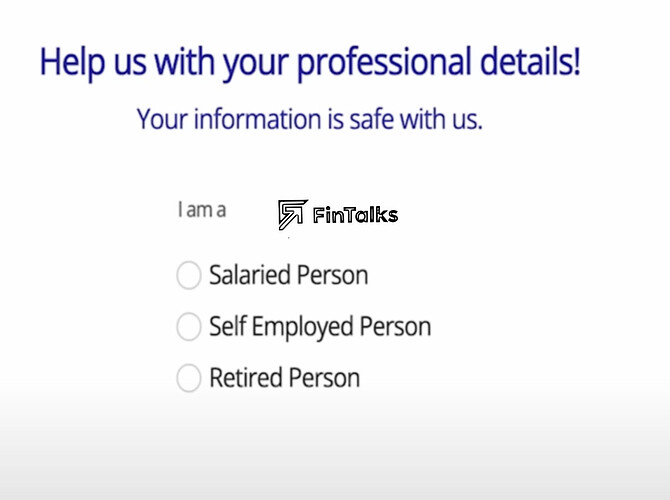

- Choose you are Salaried or Self Employed.

- On the next page, choose your Company Name and Designation.

- On the next page, choose your Work Address. Click on Continue to Step 3.

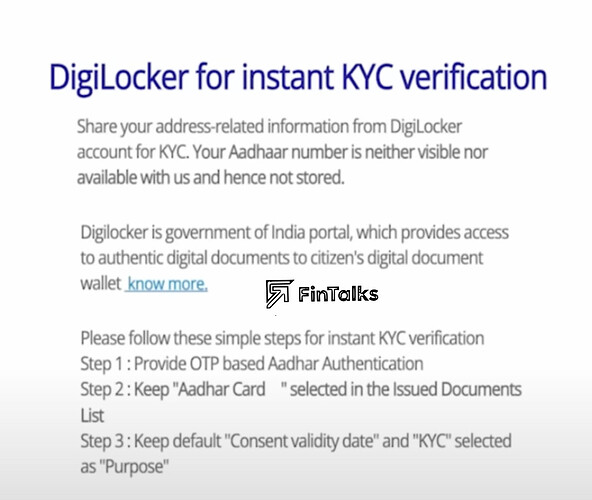

- On the next page, you have to verify your Aadhaar via Digilocker. Click on Continue to Digilocker.

- Next, login to Digilocker, and allow SBI Cards to access your Aadhaar Records.

- After this is done, SBI Card will automatically fetch your Aadhaar Address, and ask you to confirm the same as your Current Residential Address. Confirm it.

- Finally, it will ask you to choose your Verification Mode: vKYC or Online Bank Verification.

- You can choose any mode to complete the rest of the application. SBI Card may approve your application instantly, or may take some time, depending on your application details.

Once your card is approved, you can start transacting with your virtual card right away. You will get a link to view your virtual card via email. Your physical card will be delivered to you within a few days.

Note: After using your card for some time, you can Apply for SBI SimplySAVE Rupay Credit Card (First Year Free) as Additional Card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.