In case you are looking forward to apply for an SBI Credit Card, then SBI SimplyClick Credit Card and SBI Cashback Credit Card are the best cards to apply. We have already talked about SBI SimplyClick Credit Card earlier. In today’s post, we will discuss about SBI Cashback Credit Card, its benefits, and how you can apply for the same. We also have a method that you can use to waive off your card fees.

SBI Cashback Credit Card Features:

Cashback SBI Card, as the name suggests, is a credit card focused on offering cashback benefits. The card provides maximum value-back on online transactions, making it one of the best online shopping credit cards for use in Amazon, Flipkart, Myntra, etc.

- Get flat 5% cashback on all online spends, up to ₹5000 per month. Cashback not applicable on spends on the following categories: Merchant EMI & Flexipay EMI transactions, Utility, Insurance, Fuel, Rent, Wallet, School & Educational Services, Jewelry, and Railways.

- Get flat 1% cashback on all offline spends.

- Cashback earned will be credited to your card statement automatically within 2 days of card statement generation.

- Get 1% Fuel Surcharge waiver up to ₹100, on transactions of ₹500 to ₹3000.

Note: Earlier, this card used to have 2 more benefits: 5% Cashback on Utility Bill payments, and Domestic Lounge Access. Those two were removed in 2023. Still, with the remaining benefits, it is still a card worth taking.

SBI Cashback Credit Card Fees:

SBI Cashback Credit Card comes with a Joining Fee of ₹999 + GST and an Annual Fee of ₹999 + GST. Initially it was being offered as a First Year Free card, however, now that offer is withdrawn and if you want to take this card, you have to pay the joining fees.

If you do spends of above 2L in a card membership year, then your annual fee for the second year gets waived off. However, even if you do not reach 2L spends in a year, you can use this method to Get your SBI Credit Card Annual Fees waived and/or Convert your SBI Credit Card to Lifetime Free . [Note that the link given above is a “Members only” post. If you see a ‘Page Note Found’ error on the above link, please log in to FinTalks Forum to view this post.]

How to Apply for SBI Cashback Credit Card?

- Click here to Apply for SBI Cashback Credit Card.

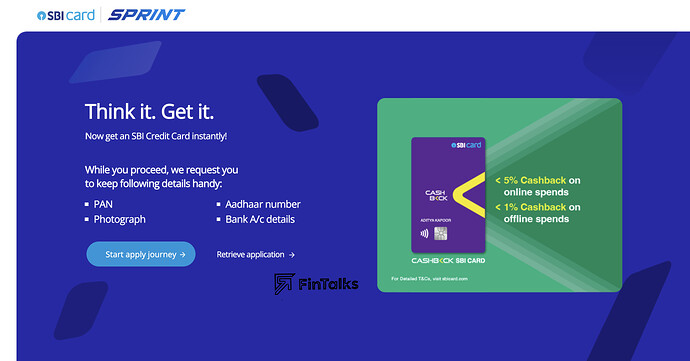

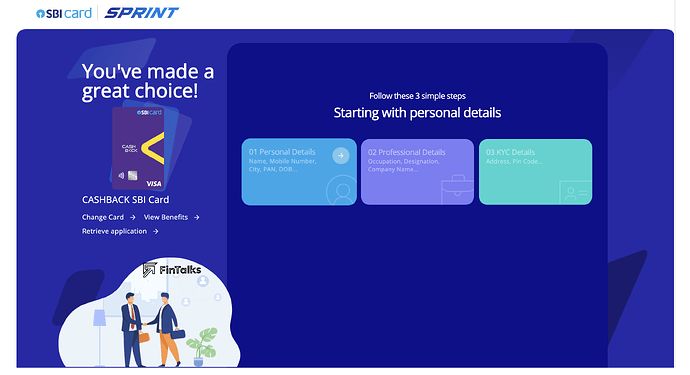

- SBI Card now gets processed via SBI Sprint portal with chances of instant approval. Click on Start Apply Journey.

- It will show Cashback SBI Card. You can click on View Benefits to check the card benefits.

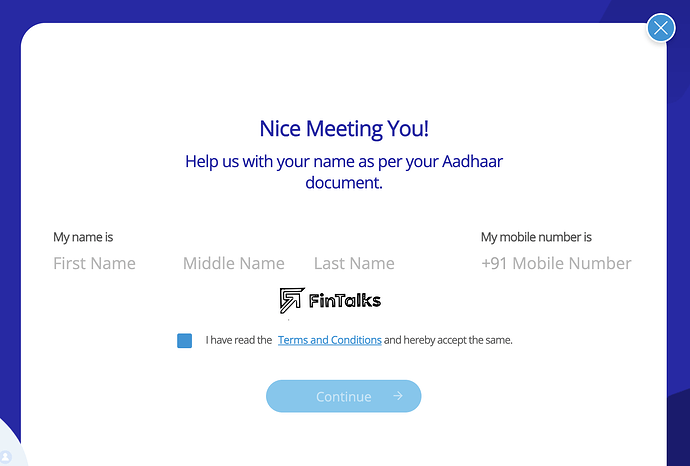

- Click on Personal Details, and enter your Name and Mobile Number.

- Click on Continue and Verify your Mobile Number with OTP.

- Next, it will ask your current residing city. Choose from the dropdown and click Confirm City.

- On the next page, it will ask your PAN Card Number, and DOB. Choose them and click Confirm.

- On the next page, enter your Mother’s name and Email ID. Click on the checkbox to confirm that you are Indian. Now, click on Continue to Step 2.

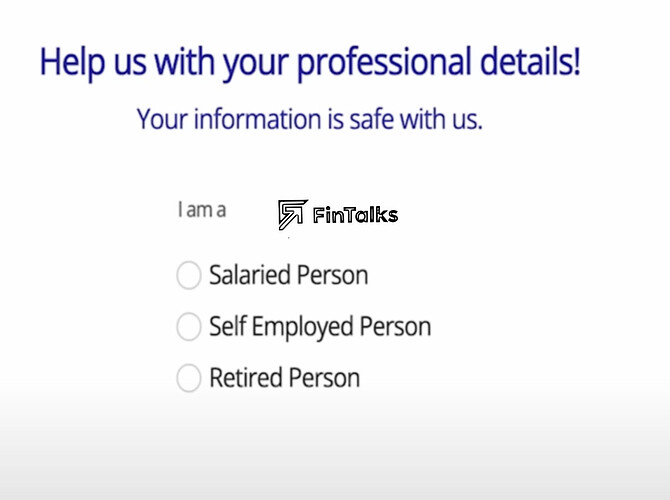

- Choose you are Salaried or Self Employed.

- On the next page, choose your Company Name and Designation.

- On the next page, choose your Work Address. Click on Continue to Step 3.

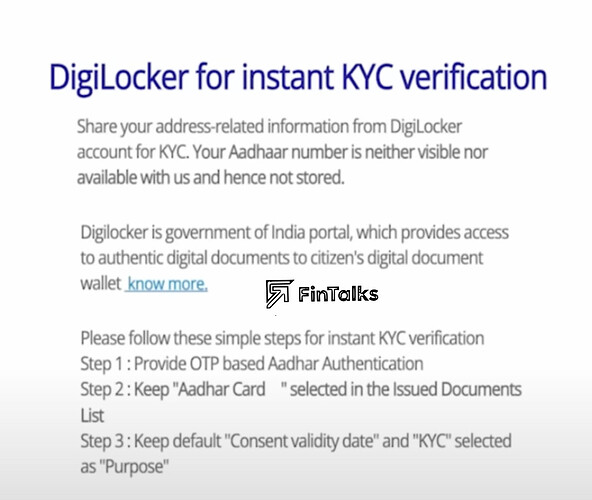

- On the next page, you have to verify your Aadhaar via Digilocker. Click on Continue to Digilocker.

- Next, login to Digilocker, and allow SBI Cards to access your Aadhaar Records.

- After this is done, SBI Card will automatically fetch your Aadhaar Address, and ask you to confirm the same as your Current Residential Address. Confirm it.

- Finally, it will ask you to choose your Verification Mode: vKYC or Online Bank Verification.

- You can choose any mode to complete the rest of the application. SBI Card may approve your application instantly, or may take some time, depending on your application details.

Once your card is approved, you can start transacting with your virtual card right away. You will get a link to view your virtual card via email. Your physical card will be delivered to you within a few days.

Congratulations! You have successfully applied for SBI Cashback Credit Card.

Note: After using your card for some time, you can Apply for SBI SimplySAVE Rupay Credit Card (First Year Free) as Additional Card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.