In case you are already holding an SBI Card, then you can apply for a SBI SimplySAVE Rupay Credit Card with no joining fees. It will be activated instantly, and you can start using it right away. Although this card has annual fees, we have a method for getting it waived, as well as converting it to Lifetime Free. Read along to find out.

SBI SimplySAVE Rupay Credit Card Features:

- Welcome Offer: Get 2000 Bonus Reward Points on spends of ₹2000 or above within 30 days of card issuance.

- Earn 10 Reward Points for every ₹150 spends on Dining, Movies, Departmental Stores and Grocery.

- Earn 1 Reward Points for every ₹150 spends on other categories.

- Get 1% Fuel Surcharge waiver up to ₹100 per statement cycle on spends of ₹500 - ₹3000.

- This card is issued on Rupay Platform. So, you can also do Merchant UPI Transactions with this card.

- Value of 1 Reward Point is Rs 0.25. You can redeem it for vouchers.

SBI SimplySAVE Rupay Credit Card Annual Fees:

-

SBI SimplySAVE Credit card comes with no joining fees (only if you apply as an additional card). If this is your first card, it will carry a joining fees of ₹500 + GST. I don’t recommend applying for SBI SimplySAVE Credit Card as your first credit card. Better to get the SBI SimplyClick Credit Card. Refer to: GUIDE: How to Apply for SBI SimplyClick Credit Card (and waive off Fees)?

-

SBI SimplySAVE Credit card comes with an annual fee of ₹500 + GST. This will be waived off if you spend 1 Lakh or more in your previous card membership year. But don’t worry, even if you do not achieve your annual spends of 1 Lakh with this card, you can use this method to Get your SBI Credit Card Annual Fees waived and/or Convert your SBI Credit Card to Lifetime Free. [Note that the link given above is a “Members only” post. If you see a ‘Page Note Found’ error on the above link, please log in to FinTalks Forum to view this post.]

How to Apply for SBI SimplySAVE Rupay Credit Card?

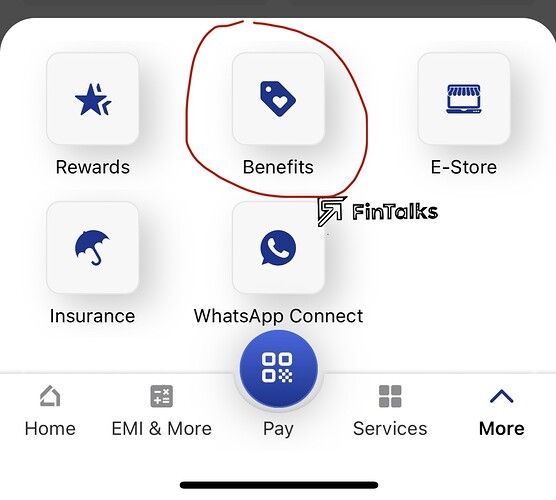

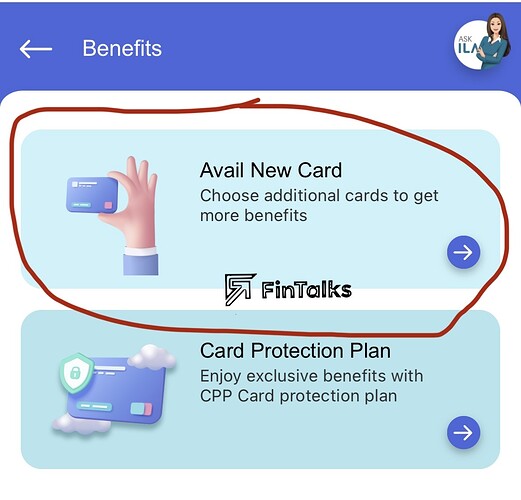

Open SBI Card App. Go to More > Benefits > Avail New Card.

You will find a list of cards there. Choose SimplySave UPI SBI Card. It will show fees ₹0 for the first year. If you don’t see this card, then this offer is not available for you. You need to wait for this offer.

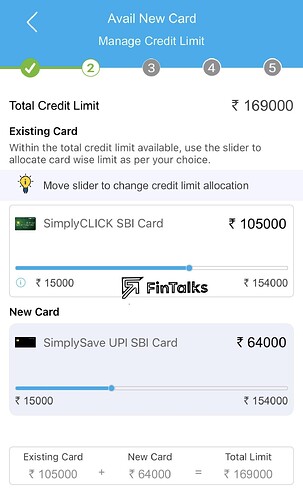

Click on Apply Now. It will ask you to split your Credit Card limit between your existing card and new card. Your new card will be issued with a split limit basis.

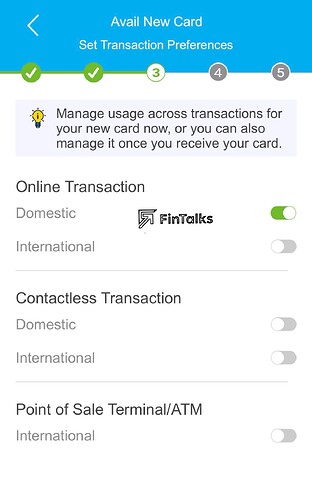

After choosing your Card limit, you can set your transaction on/off settings.

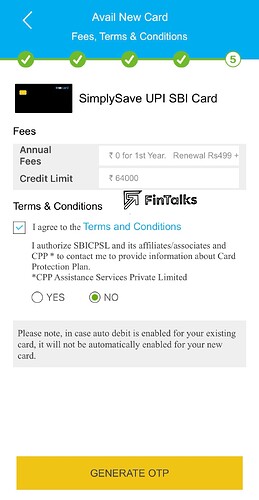

Finally, it will show you this page where you have to Agree to Terms and Conditions. Choose No in the CPP Assistance Service contact option. This is not needed.

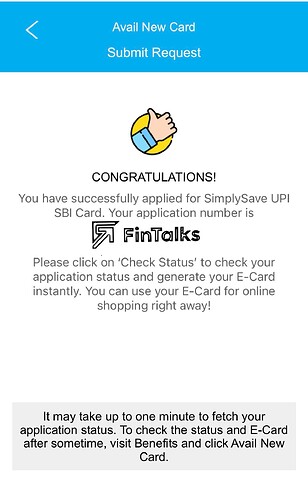

Finally, you will see this page with your application number. Congratulations! You have successfully applied for your SBI SimplySAVE Rupay Credit Card.

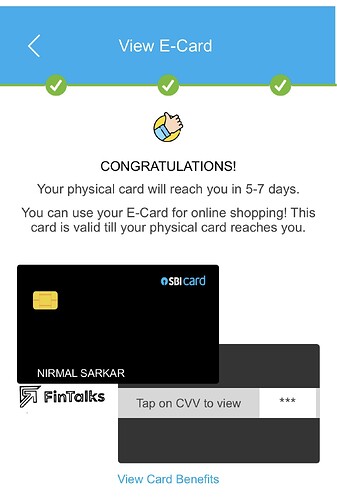

You can start transacting with your SBI SimplySAVE Credit card right away. To view your virtual card, go to the Dashboard of SBI Cards App. Then, go to More > Benefits > Avail New Card.

You can now see your virtual card details here. Your physical card will be delivered to your address within 5-7 days.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.