Want to apply for the Standard Chartered Platinum Rewards Credit Card? Check out the complete process here and you can apply right away. I got my Stanc Platinum Rewards Credit Card approved within 3 days of application.

Standard Chartered Platinum Rewards Credit Card Features:

- Earn 5 Reward Points on every Dining and Fuel spends of ₹150.

- Earn 1 Reward Points on every ₹150 spends in other categories.

- Value of 1 Reward Point = ₹0.25. 4 Reward Points = ₹1.

- Lifetime Free Card: Spend ₹500 within 30 days of card issuance and your Card will be Lifetime Free.

- No documents asked.

So, generally speaking, this is just a basic level credit card with not much rewards to offer. The only 2 reasons you should apply this card is, firstly, its carrying no charges, and secondly, for that rare card offer on Standard Chartered CC maybe on one flight booking that saves your day.

I personally applied for this card because its Lifetime Free, and I wanted to see how stringent their process is. A lot of people said they do not offer Credit Cards if you already own many cards or have recent CIBIL inquiries. I got my card approved within 2 days of applying.

How to Apply for Standard Chartered Platinum Rewards Credit Card?

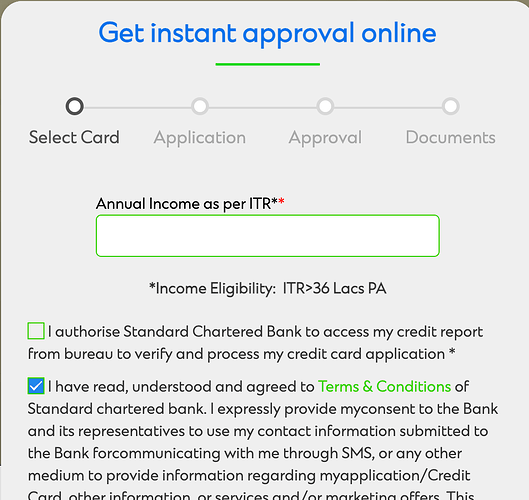

- Click here to Apply for Standard Chartered Platinum Rewards Credit Card.

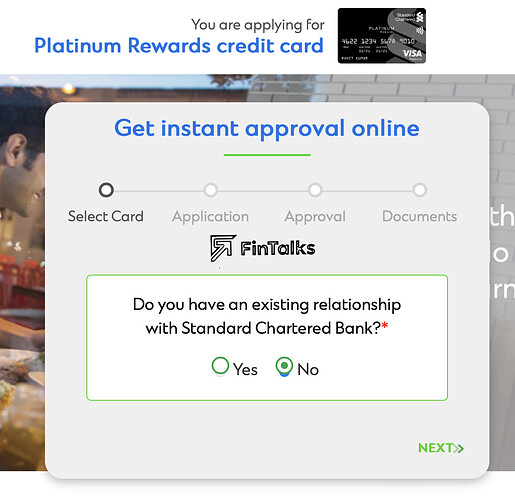

- There it will ask if you have an existing Standard Chartered Bank Relationship. Choose it.

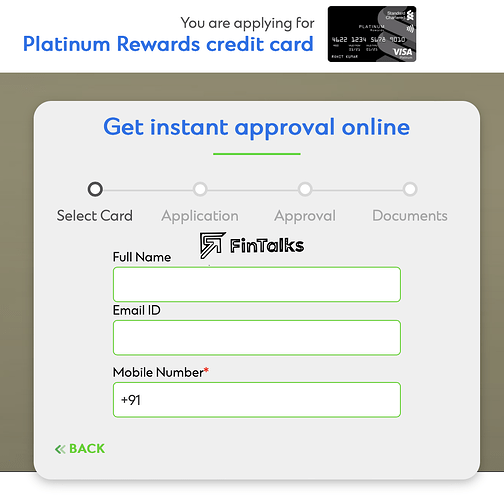

- Then it will ask your Name, Mobile Number, and Email. Confirm the same.

- Next it will ask for your Current Residential and Office Address.

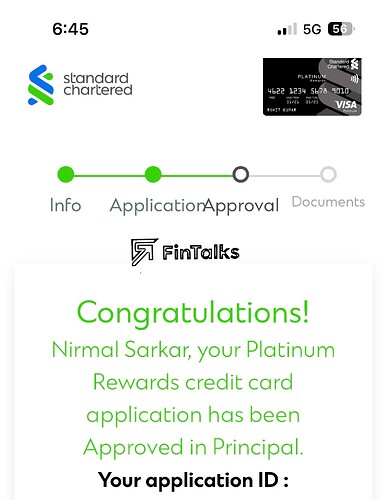

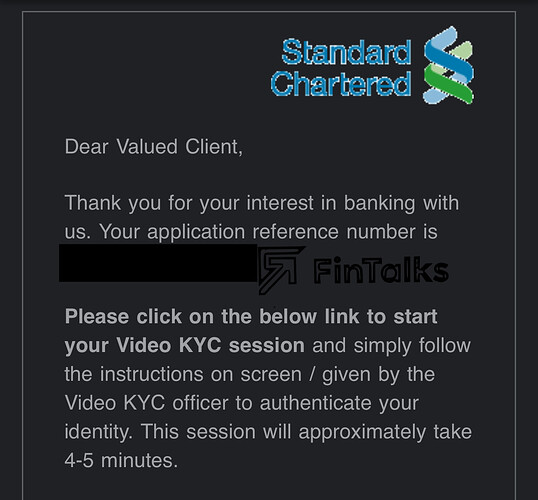

- Fill all details and submit. You will get a soft-approval message like this.

- Within 1-2 days, you will receive a call from Standard Chartered Bank. The bank executive will confirm all details on all, and help you correct any details if you did any mistakes on your application. Then they will process it after confirming OTP.

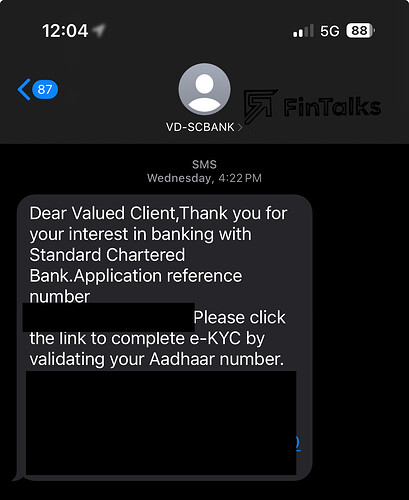

- You will get a link to complete your Aadhaar eKYC (during the executive call itself), and you have to confirm your Aadhaar details.

- You will get a link to complete your vKYC by sharing your PAN Card details (after the executive call), that you have to complete. Here’s a fact for the vKYC: If you own an Apple or Samsung device, then you have to upload ePAN to complete your vKYC, your physical PAN won’t be verified by them. You will get a call from their team later on about this.

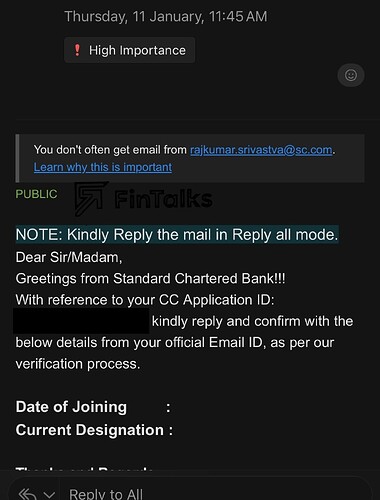

- After vKYC is completed, within 1-2 days, you will receive a mail on your official email to confirm your Date of Joining (of current job, in case of salaried) and Current Designation. You have to confirm the same.

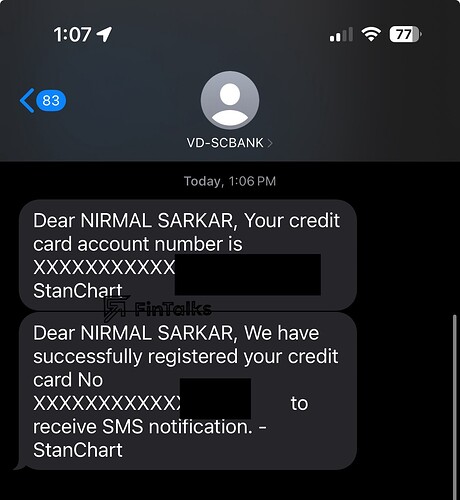

- After this, you can expect your card to be approved within 1-2 days. For me, I applied on Tuesday (9th January 2024) evening, did eKYC and vKYC on Wednesday afternoon, got official email on Thursday morning, and my card got approved on Friday (12th January 2024) afternoon. Very smooth process for me.

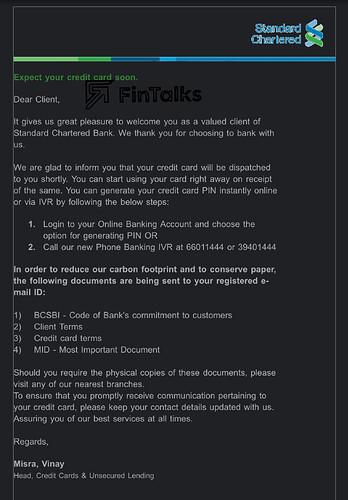

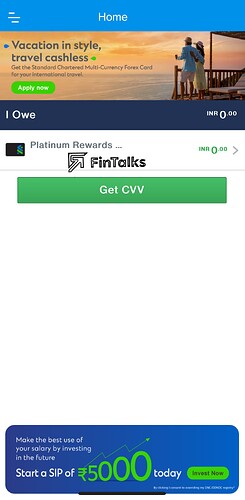

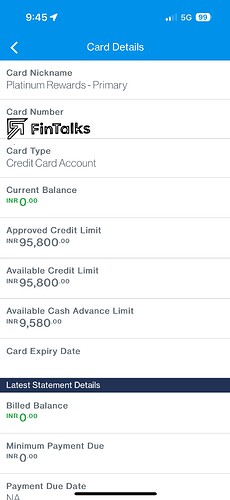

Congratulations, you have successfully applied for Standard Chartered Platinum Rewards Credit Card. Soon after approval, you will get a temporary login ID and password that you can use to register on Standard Chartered Online Banking Account or Mobile App. Inside the app you can view your full card details digitally and start transacting right away. You will receive your physical card to your communication address within 7 working days.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.