In case you are looking forward to taking an Axis Bank Credit card, then Axis Neo Credit Card and Axis MyZone Credit Card are the best entry-level cards to take. We have already talked about the Axis Neo Credit Card here. In today’s post, we will look at Axis Bank MyZone Credit Card and its features, and how you can apply for the same lifetime free.

Axis MyZone Credit Card Features:

- Get a complimentary SonyLIV Annual Subscription on paying Joining Fees. (Not Applicable for Lifetime Free Card)

- Get ₹120 off on ₹500 order on Swiggy, twice per month.

- Get Buy 1 Get 1 movie tickets on PayTM up to ₹200, once per month.

- Get ₹1000 off on Ajio on minimum spends of ₹3000.

- Get 4 complimentary domestic lounge access per year (1 per quarter).

- Earn 4 Edge Reward Points per ₹200 spends. Not valid on Fuel, Movie, Insurance, Wallet, Rent, Utilities, Education, Government Institutions and EMI transactions.

- Get up to 15% off on restaurants via Axis Bank Dining Delights.

- Get 1% Fuel Surcharge waiver on spends from ₹400 to ₹4000.

Axis MyZone Credit Card Fees:

UPDATE 15th February 2024: Axis MyZone Credit Card is now offered Lifetime Free. You do not need to pay any joining fees or annual fees.

For old users, in case you already hold a paid Axis MyZone Credit Card, then don’t worry, you can waive off your fees if you follow this method. Note: This is a private post. If you see ‘Page Not Found’ error, you need to log in to our forum to view the post.

Axis MyZone Credit Card Eligibility:

Either one of these:

- Income ₹15000 per month for salaried.

- Income ₹30000 per month for self-employed.

How to Apply for an Axis MyZone Credit Card?

Visit Axis MyZone Credit Card Application Page.

At first, enter your details on the website to check for your eligibility without making a CIBIL inquiry. Based on the details you declare (your annual income, pincode, etc.), it will tell you whether you are eligible for this card or not. In case you are eligible, you will be redirected to the Axis Bank website to apply for the card.

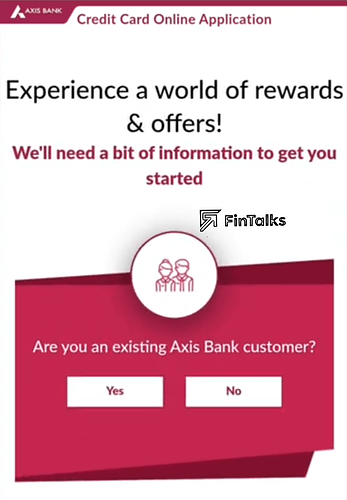

At first, you will be asked whether you are an existing Axis Bank customer. If you have an Axis Bank account, then choose Yes. If you have other Axis Bank Cards but don’t have an Axis Bank account, then don’t choose Yes. Choose No.

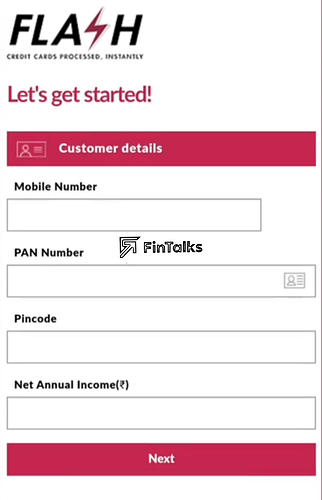

Next, you have to enter your Mobile Number, PAN Card Number, Pincode, and net Annual Income. Click Next.

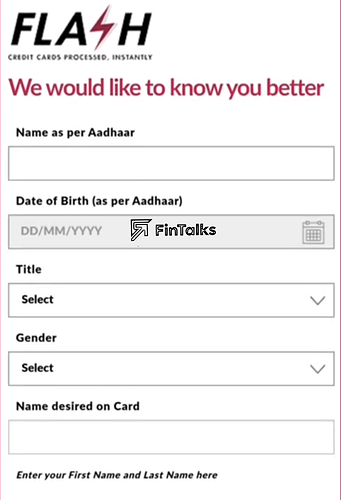

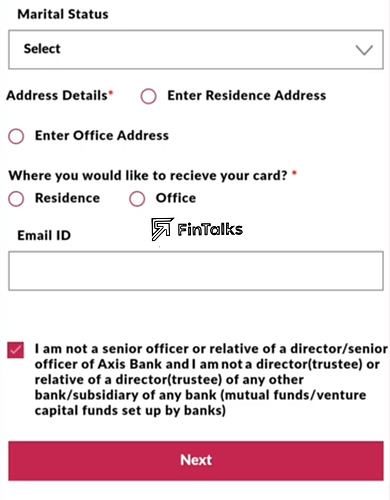

On the next page, you will be asked to enter the following details: Name (as per Aadhaar), DOB (as per Aadhaar), Gender, Mother’s Name, Father’s Name, Marital Status, Email, and Residential and Office Address.

You can choose where you want to receive the card. Click on Next.

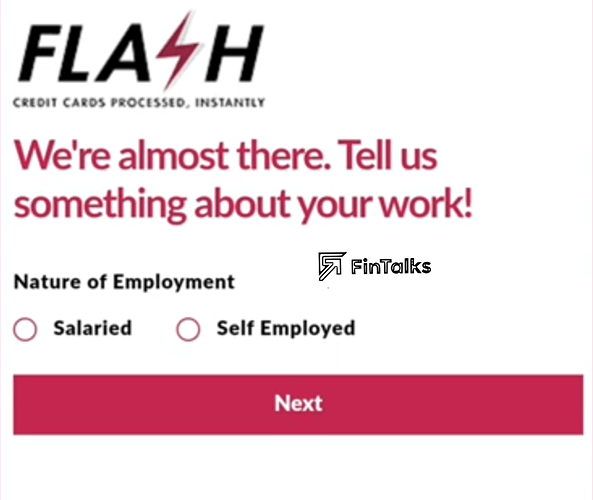

On the next page, you will be asked whether you are Salaried or Self Employed. Once you select it, you will be asked for some more Office Details like Name, Nature of Service/Business, number of years working etc. Fill it up and click on Next.

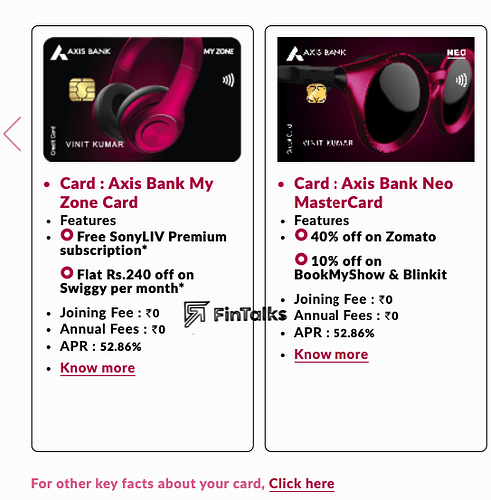

Finally, you will be shown a list of eligible cards. Choose Axis MyZone Credit Card from the list and click on Next.

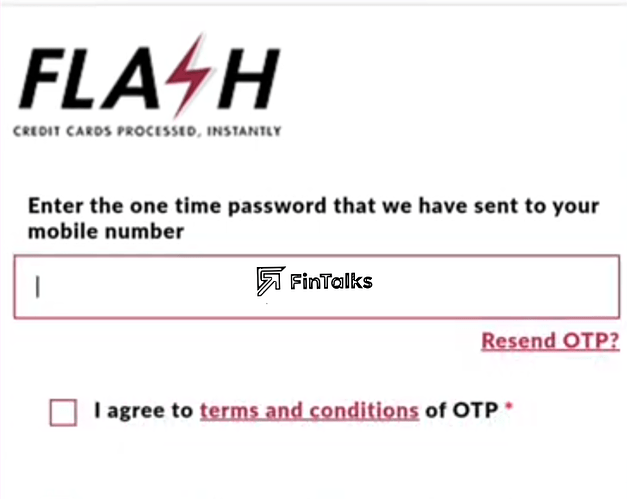

Finally, confirm your Application with OTP.

You will see this screen that your Application has been submitted successfully.

Once you submit your application, you will receive an email and SMS with Video KYC link, kindly use that to complete your Video KYC. After your Video KYC is done, your application may get approved within 1-2 days automatically. In some cases, Axis Bank may do further physical verifications. Wait for some days for updates.

Congratulations, you have successfully applied for the Axis MyZone Credit Card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.