If you have heavy usage on your Credit Cards every month, then you might want to know the best ways to pay credit card bills to squeeze out more reward points or cashback on the same.

In today’s post, I am going to discuss the HDFC BillPay portal which allows you to pay credit card bills and earn 1% Cashback on the same. So, let’s get started.

Things To Know:

-

This method applies only to HDFC Bank Account holders. In case you don’t have an HDFC Savings Account, consider opening one. Here are the HDFC Savings Account Types that you can open. You can also upgrade your HDFC Savings Account to Classic/Preferred/Imperia to avail more benefits.

-

HDFC Easyshop Platinum Debit Card holders can avail this offer via HDFC Bill Pay Portal. Details are given below.

-

HDFC Millennia Debit Card holders can avail this offer via any 3rd Party App that allows Credit Card Bill Payments like Mobikwik or PostPe or PayTM. You cannot use HDFC Bill Pay portal.

Note: PostPe gives you an additional 0.4% Cashback on their platform. Refer to: PostPe: Earn 0.4% Cashback on Credit Card Bill Payments For PayTM, you can Add Money to PayTM Wallet, you will earn 1% Cashback, and then use it to pay Credit Card Bills.

Cashback Details:

- For HDFC Millennia Debit Card, you will get 1% Cashback up to ₹400.

- For HDFC Easyshop Platinum Debit Card, you will get 1% Cashback up to ₹750.

As you have probably guessed already, you are getting higher cashback with the HDFC Easyshop Platinum Debit Card. So, you might want to upgrade from HDFC Millennia DC to Easyshop Platinum DC.

Usually, Millennia DC has ₹500 + GST charges and Easyshop Platinum DC has ₹750 + GST charges. However, HDFC High Networth Account holders have no debit card charges at all. So, you might want to upgrade your HDFC Account to Classic / Preferred / Imperia to enjoy these benefits.

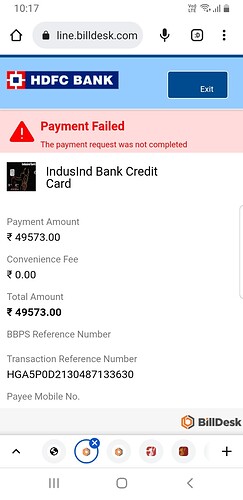

Supported Credit Cards for HDFC BillPay Portal (Applies to HDFC Easyshop Platinum DC):

- American Express Credit Card.

- Axis Bank Credit Card.

- Central Bank of India Credit Card.

- CitiBank Credit Card.

- HSBC Bank Credit Card.

- ICICI Bank Credit Card.

- IDBI Bank Credit Card.

- IndusInd Bank Credit Card.

- RBL Bank Credit Card.

- SBI Card.

- Saraswat Bank Credit Card.

- Standard Chartered Bank Credit Card.

Note: This doesn’t support HDFC Credit Cards themselves. In case you have an HDFC Credit Card, consider using platforms mentioned earlier, like PostPe or Mobikwik.

How to Earn 1% Cashback on Credit Card Bill Payments using HDFC Easyshop Platinum DC?

Method 1: Using HDFC Netbanking:

-

Log in to HDFC Bank Netbanking.

-

Click on BillPay & Recharge > Continue.

-

On the next page, Choose ‘Credit Card’ > Select your Bank.

-

Enter your Credit Card Details > Continue.

-

Enter Payment Amount, and Choose your HDFC Easyshop Platinum Debit Card as the Payment Method.

Note: You won’t earn any cashback if you choose your Bank Account as Payment Method. Choosing your HDFC Easyshop Platinum Debit Card is a must.

- Authorize your Transaction using OTP.

Your bill payment will be completed within 2-5 working days, usually sooner. You will earn the cashback on your Debit Card within 1 week.

Alternative Method: Using HDFC Mobile App:

-

Log in to HDFC Mobile App.

-

Tap on Top Left Menu > Pay > Bill Pay > Add Biller > Credit Card > Select your Bank.

-

Enter your Credit Card Details > Continue.

-

Enter Payment Amount, and Choose your HDFC Easyshop Platinum Debit Card as the Payment Method.

Note: You won’t earn any cashback if you choose your Bank Account as Payment Method. Choosing your HDFC Easyshop Platinum Debit Card is a must.

- Authorize your Transaction using OTP.

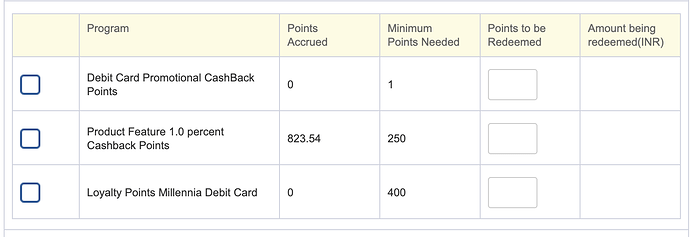

How to Redeem your HDFC Debit Card Cashback?

-

Log in to HDFC Netbanking.

-

Click on Cards > Debit Cards > Enquire > Cashback Enquiry & Redemption > Select Account > Continue.

-

You will find your Debit Cards with the Accumulated Reward Points listed over there.

-

Choose the Debit Card, Enter the Number of Points you want to Redeem, and click on Confirm.

Note: The number of points you wish to redeem needs to be in multiple of the minimum no of points necessary for redemption. For Millennia DC, it is 400 and multiples of 400. For Platinum CC, it is 250 and multiples of 250.

- On the Next Page, Click on Confirm Again.

That’s all. Your points will be credited to your Bank Account within 2 working days (usually sooner).

References: Follow this FinTalks Facebook Group Post by Rahul Diwan.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.