In case you are using a lot of credit cards and paying a high volume of credit card bills every month, then you will definitely be interested in the best ways to pay credit card bills.

In my earlier post, I talked about the HDFC BillPay portal that allows you to Earn 1% Cashback on Credit Card Bill Payments. But it will only work if you are an HDFC Bank customer with HDFC Easyshop Platinum Debit Card. It also does not support HDFC Credit Card Bill Payments.

An alternative way to earn Cashback for Credit Card Bill Payments is by using PostPe App. You can earn 0.5% Cashback with PostPe. Keep reading today’s post to learn more.

Who should use this method for Credit Card Bill Payments?

- If you are using an HDFC Bank Credit Card.

- If you are using an HDFC Debit Card other than Easyshop Platinum. (such as HDFC Millennia DC, Times Point DC, etc.)

- If you are NOT having an HDFC Bank Account. (Seriously though, please create an HDFC Bank Account, you are missing out on lots of offers, and discounts)

- If you have already maxed out the HDFC BillPay 1% Cashback Offer on Credit Card Bill Payments, but still need to do more credit card bill payments.

PostPe Credit Card Bill Payments Cashback Scheme & Maximum Limits:

PostPe is a BNPL Card from BharatPe Team, that provides you with an upfront credit line (in the form of a card) that you can use to do online and offline transactions. It works similar to Slice, LazyPay, etc.

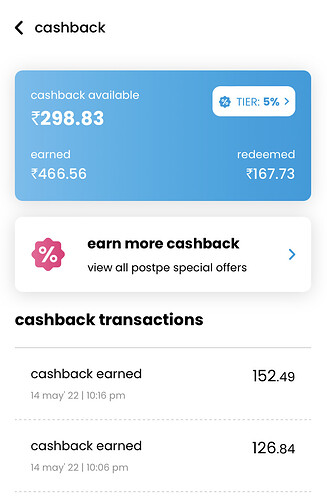

Another interesting feature of PostPe is that it provides 0.5% Cashback on Credit Card Bill Payments.

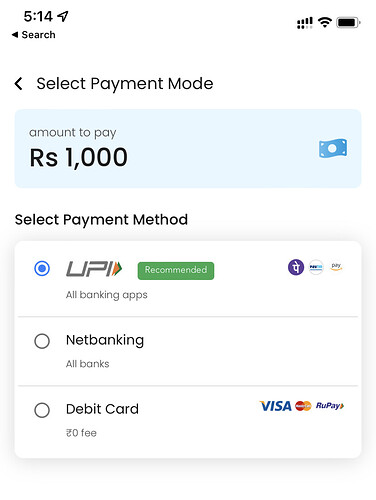

- Credit Card Bill Payments can be done with Debit Cards, Netbanking, or UPI.

- Credit Card Bill Payments cannot be done with PostPe Credit Limit.

- Upon Successful Credit Card Bill Payment, you will earn 0.4% Cashback.

- Transaction Maximum Cap ₹1000 per month. (This means you can maximum do Bill Payments of 2.5L per month)

- This Cashback amount will be adjusted in the next billing cycle of your PostPe BNPL Card.

How to use PostPe App to pay Credit Card Bills?

- Download PostPe App.

- Sign up with your Details.

- Check your Eligibility. In case you are approved for PostPe, you can find it inside the app.

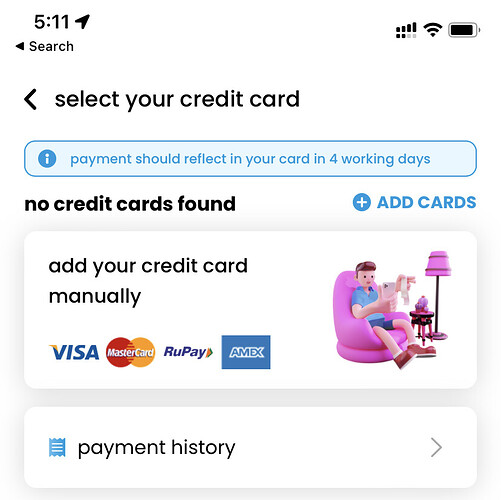

- In the Dashboard, click on ‘Pay any Credit Card Bill’.

- Click on ‘Add Cards’ and enter your Credit Card Details, and click confirm.

- On the next page, enter the amount you want to pay and click Pay.

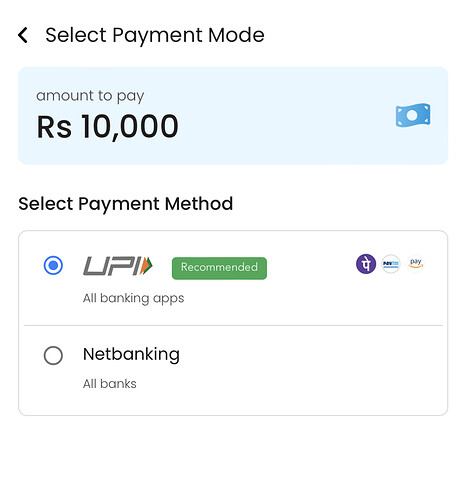

- Choose your Payment Method: UPI, Netbanking, or Debit Card, and complete your payment.

Your bill payment will be credited within 4-5 days maximum (usually within 2 days). You will earn cashback using any type of payment mode. No worries.

Things to Know:

- In case you use the Debit Card payment method, you will earn any rewards associated with your Debit Card. For example, HDFC Millennia Debit Card users will earn 2.5% Cashback up to ₹400 per month.

- In case you use the UPI payment method, you will earn any rewards associated with Merchant UPI Payments. For example, Axis Liberty Accounts will be eligible to consider these UPI Payments for their 25k spends per month MAB requirement limits or 60k spends per quarter milestone limits.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.