LazyPay is a Buy Now Pay Later service. It provides you with an upfront credit limit which you can use via UPI or BNPL Card.

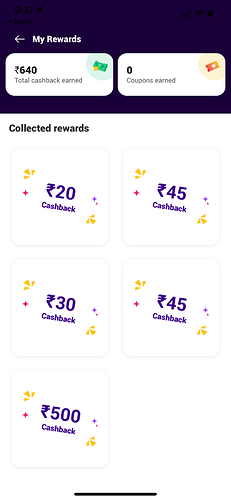

You will also earn up to 5% cashback against every transaction.

Currently, LazyPay is running an offer: Earn ₹500 on your first transaction with LazyPay. No minimum transaction amount is needed. You will get ₹500 cashback in your LazyPay wallet instantly.

Features of LazyPay:

- Payment Processor: VISA Platinum.

- Banking Partner: SBM Bank.

- Charges: Lifetime Free Card.

- Welcome Bonus: Earn ₹500 cashback on your first transaction of any amount.

- Cashback: Earn up to 5% cashback against every transaction.

- Billing Cycle: Unlike credit cards, which have a monthly billing cycle, LazyPay Billing cycle is twice per month: 1st to 15th of a month with due date 18th of the same month, 16th to 31st of a month with due date 3rd of the following month.

How to Apply?

You can apply for LazyPay Card in these easy steps.

- Download LazyPay App.

- Sign up and complete your KYC authentication.

- Your credit limit will be generated based on your Credit Profile.

- You can start using your LazyPay account instantly.

- You can apply for the LazyPay Card from inside the App. Please note that this card is being rolled out on an invite-only basis, however, everyone will be getting it sooner or later.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.