In case you are already holding an IndusInd Bank Credit Card, then you can now apply for the IndusInd Bank Platinum Rupay Credit Card as an additional card. This card is Lifetime Free. No charges associated with it.

Important Points:

- To apply for the IndusInd Bank Platinum Rupay Credit Card, you have to have an existing IndusInd Bank Credit Card active. This credit card will be issued as an additional card. In case you do not have an IndusInd Bank Credit Card, and you want to get a good IndusInd Credit Card, refer to: GUIDE: How to Apply for IndusInd Legend Credit Card Lifetime Free?.

- If you already have 2 IndusInd Credit Cards such as the IndusInd Legend Credit Card and IndusInd Eazydiner Platinum Credit Card, still you can apply for the IndusInd Eazydiner Platinum Credit Card as the 3rd Card.

- You will get the physical card delivered to your address registered with the bank, within 7 working days.

- You can use the IndusInd Bank Platinum Rupay Credit Card for both regular online transactions and UPI payments.

- IndusInd Bank issues credit cards on a split-limit basis. This means you have to split your existing credit card limit into 2 parts. IndusInd Bank DOES NOT issue credit cards on a shared limit basis.

- You will get separate credit card statements for both the cards and you have to pay them separately.

- There will be NO CIBIL INQUIRY since this is pre-approved for you.

- If you already own a IndusInd Platinum Credit card then this method might not be available for you. You can comment below to update me about the same.

How to Apply IndusInd Bank Platinum Rupay Credit Card Lifetime Free?

Click this link to visit IndusInd Platinum Additional Card website.

Click on Check Eligibility.

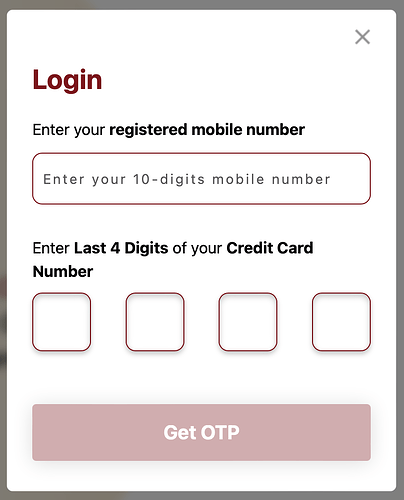

Enter your Mobile Number, and enter the last 4 digits of your existing IndusInd Bank Credit Card Number. Click on Get OTP. Verify your number with OTP.

Then wait for some seconds while the bank will check your eligibility for getting this credit card. Once you get approved for this card, you can confirm your mailing address to get your card delivered.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.