IndusInd Bank and Eazydiner have partnered again to launch a Lifetime Free Credit Card for everyone that offers decent rewards on dining, especially if you frequently use the Eazydiner App. Here are the complete details of the IndusInd Eazydiner VISA Platinum Credit Card.

Important Notes:

- Don’t confuse this card with the IndusInd Eazydiner VISA Signature Credit Card, which is a different card, and is only available as a Paid Card with an annual fee.

- This is a co-branded Credit Card between IndusInd Bank and Eazydiner. It comes on VISA Platinum platform as of now.

- You cannot apply for this card if you already own an existing IndusInd Credit Card (this information is given to me by the Eazydiner personnel who called me to process my application, and hence I couldn’t apply for this, since I already own a Lifetime Free IndusInd Legend Credit Card). Refer to: GUIDE: How to Apply for IndusInd Legend Credit Card Lifetime Free?.

- Your income documents (salary slip / ITR) will be needed for processing this credit card application.

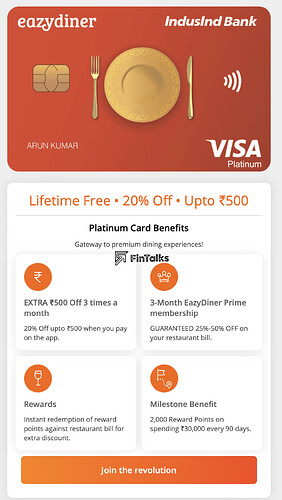

Eazydiner IndusInd VISA Platinum Credit Card Features:

- Get 3 months of Eazydiner Prime Membership as a Welcome Benefit.

- Get an extra 20% off up to ₹500 when you eat out and pay using PayEazy using the Eazydiner App, 3 times a month.

- Milestone Benefit: If you spend ₹30000 every 90 days of card membership, you will earn 2000 Reward Points and also get 3 months of Eazydiner Prime Membership.

- Earn 2 Reward Points on every ₹100 spent. (Except fuel, insurance, government, rent and utilities).

- Earn 0.7 Reward Points on every ₹100 spent on Insurance, Rent, Utilities, and Govt. spends.

- You can redeem your Reward Points instantly against your restaurant bill while paying with Eazydiner app.

- Earn 2X Eazypoints everytime you complete a booking on Eazydiner.

- 1% Fuel surcharge for transactions between ₹400 and ₹4000.

How to Apply for Eazydiner IndusInd Lifetime Free VISA Platinum Credit Card?

There are 2 ways of applying for this card. You can apply via Eazydiner App. Check out the Eazydiner IndusInd Credit Card banner and apply from inside the app.

You can also apply from the Eazydiner Website.

It will ask for your basic details like name, phone number, PAN Card Number etc. Once you submit your details, you will get a call from Eazydiner team within a few hours. Everything will be processed on the call.

It is recommended that you have a monthly income of above 40k (for salaried) You will need your 3 months payslip if you are a salaried person, or ITR if you are a self-employed person. Once your application has processed, it will take another week to get your card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.