A lot of old OneCard Metal Credit Card users (like me) are getting notifications to upgrade their OneCard to get new features and benefits.

What are the added benefits? Should you upgrade? Will this impact your CIBIL? Let’s discuss this in detail.

What is the OneCard Upgrade? Why it is being done?

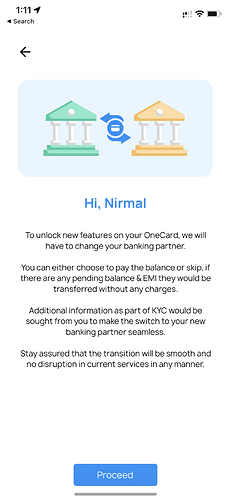

OneCard initially started its business operations by partnering with IDFC First Bank. Gradually, they introduced OneCard with Federal Bank, SBM Bank, South Indian Bank, as well as Bank of Baroda. Eventually, they are ending their relationship with IDFC First Bank, and they are in the process of migrating the OneCard IDFC Variant users to some of their new banking partners.

So, if you are using a OneCard with an IDFC First Bank variant, then you will get a notification asking you to upgrade your OneCard, which will change your banking partner. Most users are getting South Indian Bank or Federal Bank. You DO NOT have an option to choose your banking partner, it is automatic.

Remember, sooner or later you need to switch to the new OneCard because the OneCard-IDFC Partnership is ending. We don’t have confirmation, but as per one of our FinTalks members, the IDFC OneCard is going to close by the end of April 2022. So, make sure to upgrade yourself before that.

Benefits of the New Upgraded OneCard Metal Credit Card:

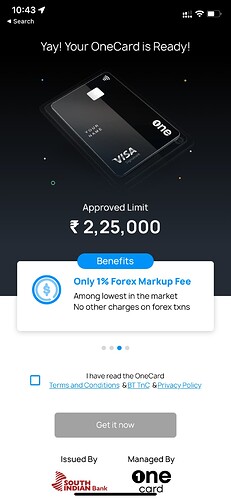

To make your transition process rewarding, OneCard has introduced some cool features that you will be getting with your upgraded OneCard.

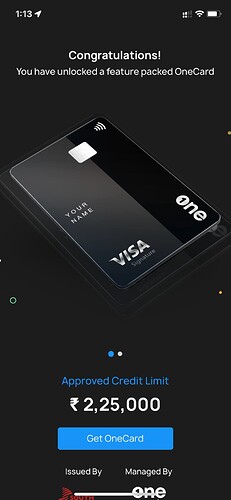

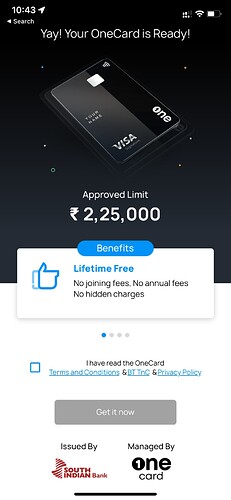

- New Metal Credit Card. Yes, you will be getting another Metal Card!

- Increase in Credit Limit (for selected users only, some got 10% increment in credit limit).

- 5000 Bonus Reward Points once your upgrade process is complete. This can be cashed out, valued at ₹500.

- Option to Apply for OneCard Add-on Credit Cards for your Family Members with a shared limit.

- Set up Auto Repayment option, so that you don’t need to worry about paying bills.

- Add your OneCard on the Google Pay payments app to pay using your OneCard.

- Bharat QR Payments Support.

- A Subscription Hub to track all your Recurring Payments inside the OneCard App.

- Track your New OneCard Delivery Status from inside the app.

All in all, the only good thing is getting ₹500 for free, and the possibility to apply for Add-on Cards! And since you don’t have much of a choice here, you can upgrade it!

What about IDFC OneCard Lite users?

Those using OneCard Lite Secured Credit Card with FD also will be getting an upgrade option. However, if you are using an existing plastic OneCard, you will be getting a plastic card only.

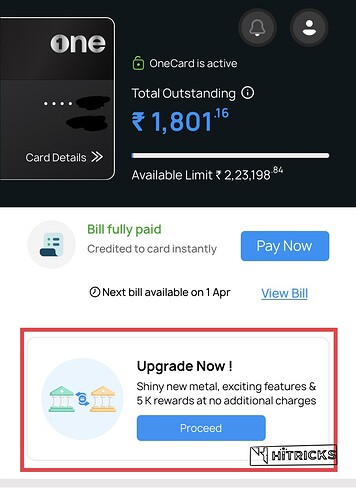

How to Upgrade your OneCard?

The upgrade process is gradually being rolled out. Wait patiently, and you will get an email as well as an in-app notification to upgrade your OneCard.

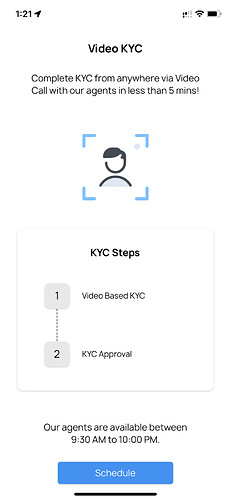

Proceed with the upgrade. You will be notified that your banking partner will be changed. As a part of this process, you need to freshly initiate your KYC process. You can also choose your address for card delivery.

You need to enter your Aadhar and PAN Number.

Once your vKYC is done, you will know the status of your application within 15 minutes. In my case, it was approved successfully.

It will be despatched via Bluedart within 2 days of approval, and you will be getting it within another 48 hours if you are staying in any metro city.

Here’s my overall OneCard Upgrade timeline:

22nd March 2022: Applied for Upgrade.

23rd March 2022: vKYC Done. Card Upgraded.

25th March 2022: Card Shipped via Bluedart. I am writing this post now. I will be getting the delivery on 26th March 2022.

OneCard Metal Credit Card Upgrade FAQ:

Q: Is it mandatory to upgrade my IDFC OneCard?

Ans: OneCard is ending its partnership with IDFC. Sooner or later, you need to upgrade your card. So, better to do it now, while they are giving away ₹500 for free.

Q: I haven’t got any notification for OneCard Upgrade.

Ans: If you are using IDFC OneCard, you will be getting the upgrade notification soon. If you are using another banking partner OneCard, you can keep using your current card. This doesn’t apply to you.

Q: What happens to my existing Reward Points?

Ans: Your existing reward points will be automatically transferred to your new OneCard.

Q: Will this upgrade Impact my CIBIL Score?

Ans: OneCard says no. However, my analysis says there may be a minor, temporary impact. But no need to worry about it, since your Credit Score is unlikely to change with this.

Let me explain:

What is happening here is:

- Your existing CC account with IDFC First Bank is getting closed.

- You are opening a new CC account with another banking partner.

- Both CC accounts will be having same or slightly increased limits.

- Your OneCard Reporting Account remains the same.

Two things to keep in mind,

- Your Banking partner is only keeping your KYC Details. They are not involved in fetching your Credit Profile or analyzing your Creditworthiness.

- OneCard is pre-approving all the applications, without doing any CIBIL inquiries, since these are all their existing relationships.

Hence, your CIBIL score is unlikely to change here. But yes, you will notice a closed CC account with IDFC and a newly added CC account with your new banking partner on your CIBIL. This will reflect in your next month’s CIBIL report.

Q: My Address is unserviceable, Can I take delivery on a Serviceable Address?

Ans: Absolutely, yes. During the application process, it will ask you to choose your Address for delivery. You can either select from your pre-selected addresses, or add a new address.

Q: Do I need to clear my dues before switching to my new OneCard?

Ans: This is up to you. You can choose to repay the bills, else your outstanding amount will be transferred to your new OneCard automatically.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.