Good News, OneCard Metal Credit Card has finally introduced Add-on Cards, and in case you own a OneCard, you can easily apply for Addon Credit Cards for your family members at no additional costs.

What is a Addon Credit Card?

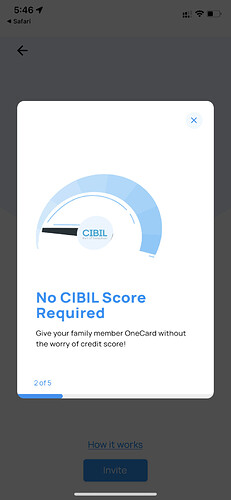

An Add-on Card is a secondary card provided to your direct family members. It is of the same variant as the primary card and shares the same features as the primary card. I have already written a detailed post on What is Addon Credit Card, what are its benefits. Check it out: Add-on Credit Cards Explained: Features, Benefits, How to Apply?

Things to Remember:

- If you are using OneCard with IDFC, it won’t be eligible for Addon Card. You need to Upgrade your OneCard before trying this.

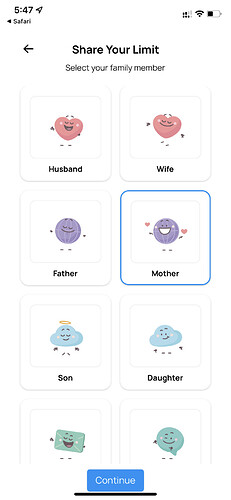

- One Primary OneCard Holder can opt for up to 2 Add-on Cards.

- You can choose Metal or Plastic Add-on Cards. Metal Card will be chargeable at ₹3000+GST. Plastic Card will be free.

- At this moment, OneCard is running a promotional offer where you will be getting 500 Reward Points (which translates to ₹50) per plastic addon card invite (5000 Reward Points for Metal Card though, but it is chargeable at 3k+GST).

How to Apply?

Locate the ‘Add Family Member’ option inside OneCard App. If you cannot find it, you can click this link: https://1cardapp.page.link/myfamily (from Mobile Device) and it will open inside OneCard App. (Try a few times if it doesn’t work in one go, or copy-paste the link on chrome browser so that it redirects to OneCard)

The process is this:

- You enter Addon Cardholder Name (as per PAN) and relationship.

- You choose the card limit (choose a total limit to get on a shared basis)

- You choose the type of card (plastic or metal)

- Confirm the other details and you will get an invite link.

- Share it with Addon Cardholder.

- The addon cardholder needs to sign up with that link and add their details.

- The OneCard Addon card will be despatched to the registered address of the primary cardholder.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.