Introduction:

The first time you invest in a Mutual Fund using any medium (Read: Best Apps to Invest in Direct Mutual Funds), your bank account information is updated with the KYC registry KFinTech and CAMS.

This information is used as the default bank account option for fund redemption purposes for all your future mutual fund investments across all AMCs.

In case you want to update/modify your bank account details, earlier you had to reach out to each AMC individually and place a request. However, now the process has become easier after the introduction of the MFCentral Portal.

MFCentral is an online portal jointly created by KFinTech and CAMS where you can manage all your Mutual Funds in one place. You can check your portfolio, and place many service requests from there.

Using this portal, it has become very easy to update your Bank Account information in one click.

Prerequisites:

This process is fully online and will take less than 5 minutes. However, you need to keep a few things handy:

- Your PAN Card No.

- Your Old Bank Cheque Book.

- Your New Bank Cheque Book.

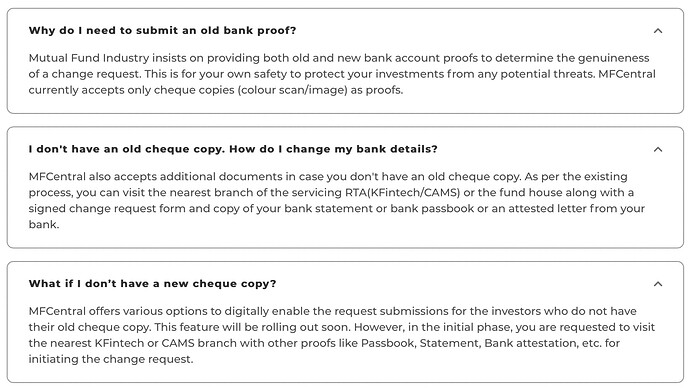

What if I do not have a Bank Cheque Book?

As of now, only a scanned copy of your bank cheque is accepted as proof of your bank account on the MFCentral portal. Nothing else is accepted. In case you don’t have a cheque book for your bank account, you need to visit your nearest KFinTech/CAMS servicing branch to submit a copy of your bank statement, and they will process the request. Note that this is an ‘offline’ process.

Find your nearest KFinTech or CAMS servicing Branch from here:

Important Things To Note:

-

You can only use this method if your total investment corpus across all mutual funds is less than 10 Lakhs. If your investment is more than 10 Lakhs, and you wish to update your bank account, you need to use the offline method described above.

-

Once you update your bank account, there will be a 10-day cooldown period, within which you won’t be allowed to redeem your funds. This is done mainly for security purpose, to avoid fraudsters from running away with your money.

With all these out of the way now, let’s begin:

Types of Possible Bank-Account Modifications:

You can do the following Bank Account Modifications:

- Change (or fully replace) your old bank account with a new bank account.

- Add a new bank account (in addition to your old bank account).

- Change your ‘default’ bank account for redemption (in case you have more than one bank accounts added to your MFCentral Account).

Step-by-Step Process to Change your default Bank Account for Mutual Fund(s):

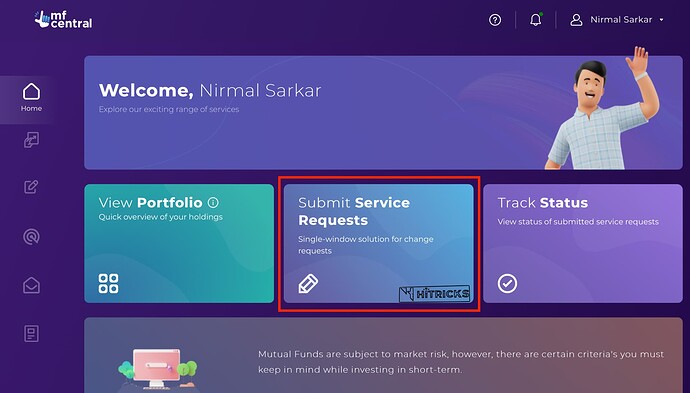

- Sign up or Log in to the MFCentral Portal. You will need your PAN Card Number, as it is the only unique identifier that links all your Mutual Fund investments.

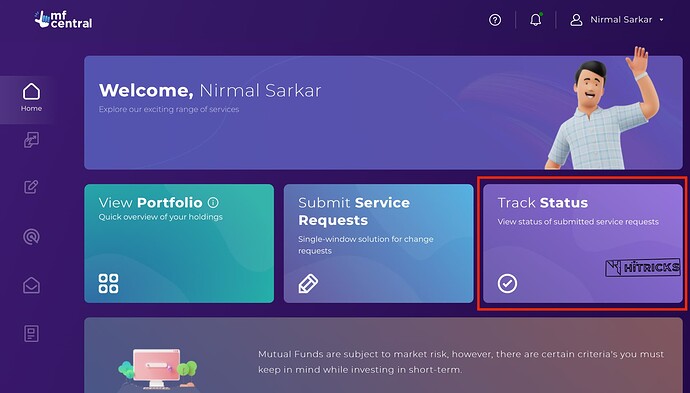

- Once you come to the main dashboard, click on ‘Submit Service Requests’.

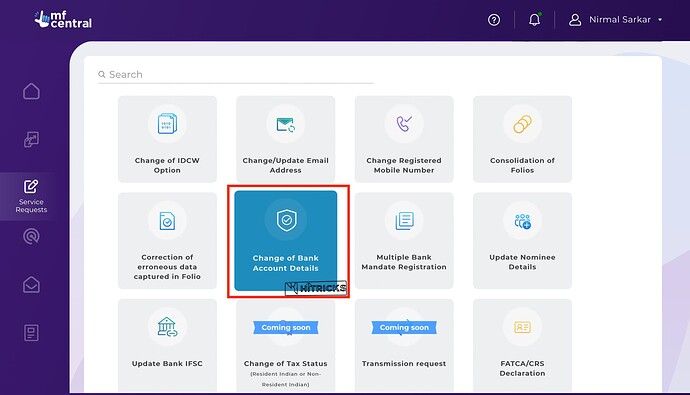

- Choose ‘Change of Bank Account Details’.

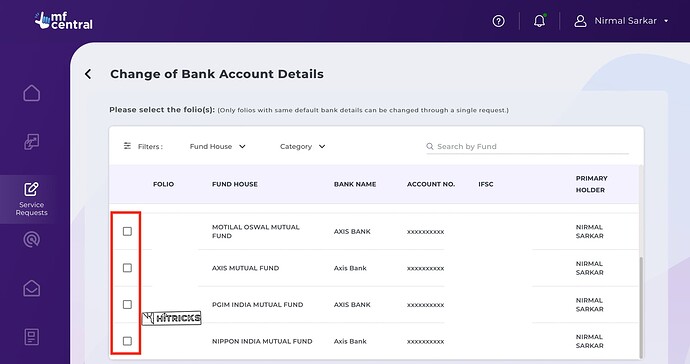

- You will find a list of all your Mutual Fund AMCs with a check-box on the left. Select the funds you wish to update the bank accounts for. In case you want to update the bank account for all your funds, select all of them. Click the ‘Submit’ button at the bottom.

Note: This list of AMCs will include all your previous Mutual Fund investments, including the ones in which you have fully redeemed all your funds. It is up to you whether you want to choose all of them or not.

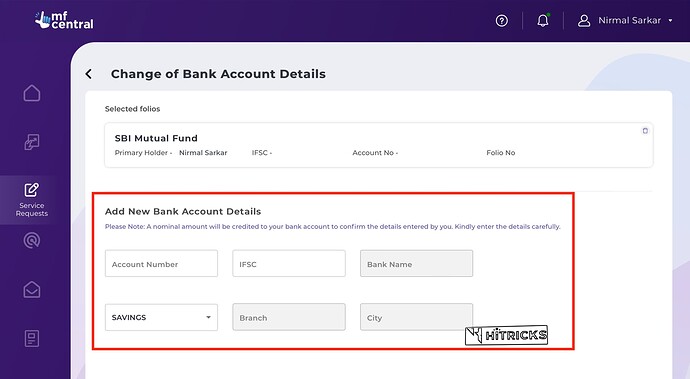

- You will be asked to add your new bank account details over there.

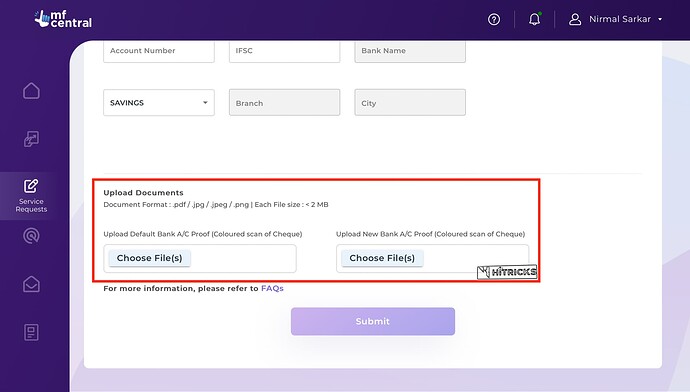

- Next, you need to upload your old and new bank cheque copies as your bank document proof. Please ensure you upload a colored scanned image of your bank cheque. Place your cheque book on a white background (a white page will be good as a background) and click a clear image with your mobile phone.

Click ‘Submit’ when you are done.

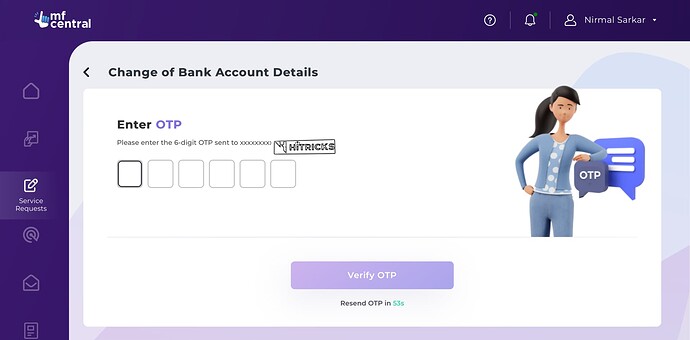

- Next you will get an OTP to authorize this service request. Confirm the same.

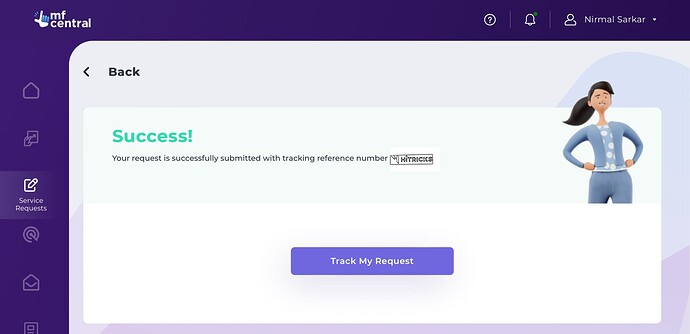

- Finally, you will see a confirmation message: Your request is successfully submitted with a reference number.

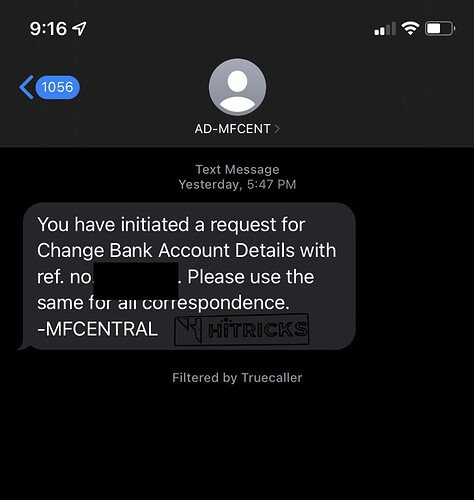

You will also get an SMS confirming the same.

Congratulations, you have successfully applied for updating bank account details for your Mutual Fund investments.

Track your ‘Change of Bank Account’ service request:

As soon as you place your service request, MFCentral will process your request to all your AMCs. It may take from a few minutes up to a few hours for the respective AMCs to update your bank account change request.

You can track your service requests from the ‘Track Status’ option in your MFCentral Dashboard.

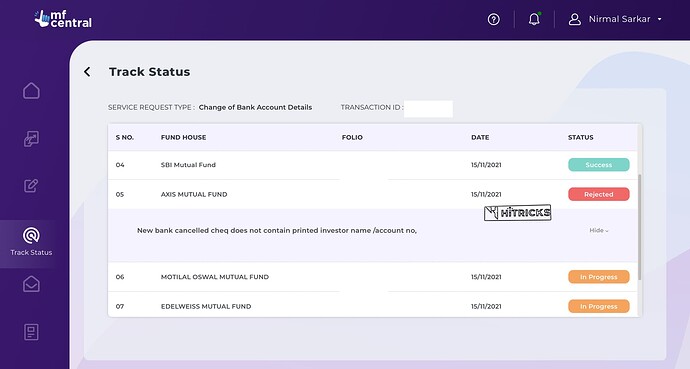

You can find the status for individual AMCs. If an AMC approves the request, it will show as ‘Success’. In case your request gets disapproved, it will show as ‘Rejected’, and for the pending requests, it will show as ‘In Progress’. In case an AMC rejects your request, you can view the reason from there also.

Check the below screenshot, where my request was approved by SBI Mutual Funds, however, rejected by Axis Mutual Funds. The reason cited by them was, my new bank cheque does not contain my name in printed form. Note that the same scanned copy was sent to all AMCs.

Regarding the time taken for the bank account change, SBI, HDFC, and Parag Parikh AMC were the quickest. They processed it within 5 minutes of placing the request from MFCentral. Also note, I placed the request on a Monday evening at 5.45 pm. Nippon India processed it within an hour (6.35 pm to be precise). Axis Bank rejected it the next morning at 6.59 am sharp. A few are still pending at the time of writing this post at 9.30 am. I am expecting them to process the same by the EOD.

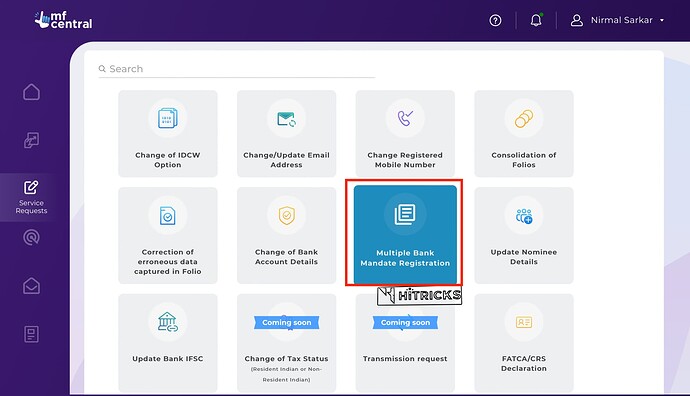

How to add a Secondary Bank Account to your Mutual Funds AMC?

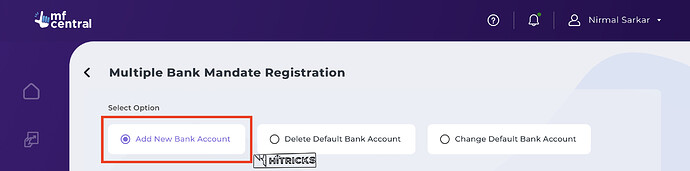

Use this method in case you want to add another bank account without removing your earlier bank account. The entire process remains the same, only the service request type should be ‘Multiple Bank Mandate Registration’.

On the next page, choose ‘Add a New Bank Account’.

How to Change your Default Bank Account for Mutual Funds?

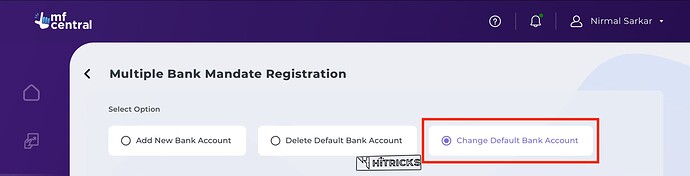

This will only work if you have more than one bank accounts registered, and you wish to process your redemption request from your primary bank account to your secondary bank account.

The process is similar to the earlier one, except choose the ‘Change Default Bank Account’ option.

You can also ‘Delete Default Bank Account’ from there if you wish so.

Conclusion:

Overall, the process for updating your bank accounts for all your Mutual Fund investments is pretty straightforward, hassle-free, and fast. Try it out and let me know if this works for you. You can follow this thread on our FinTalks Facebook Group.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.