In case you have a PostPe Pay Later active, and you want to close it, you can follow this guide:

Know your PostPe Pay Later Financial Service Provider:

PostPe Pay Later is offered by SBM Bank. You can also inspect your CIBIL report to confirm it.

You may also check out list of loan/pay later accounts on your CIBIL.

To cancel your PostPe Pay Later Account, you need to contact both PostPe and SBM Bank Customer Support. You may need to take additional steps also since PostPe doesn’t seem to close your account by default.

In this post, I will lay out all the levels that you can reach out to, if you need to close your PostPe Account.

How to Permanently Close PostPe Pay Later?

Level 1: Contact PostPe Customer Support:

Email: help [at] postpe [dot] app.

Not sure what to write? Use our BNPL Permanent Closure with NOC Email Template . Please note that you can only access this link if you are LOGGED IN to our Forum. Else you’ll see Page Not Found Error.

Make sure you ask them for permanent closure, not a ‘temporary pause’ or ‘inactive’ account.

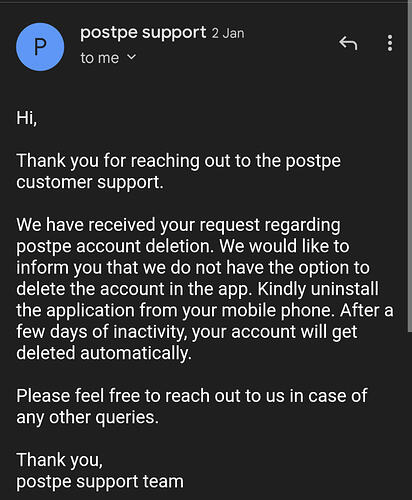

But, as lots of people have pointed out, they won’t honor your request. Instead, they will suggest you to ‘Uninstall’ PostPe App, which sounds ridiculous. Remember it is your right to close any kinds of active loan or credit card accounts and get a NOC under your name.

Don’t get disheartened if you get the same reply. Move to Level 2.

Level 2: Contact SBM Bank Support.

Email: customercare [at] sbmbank [dot] co [dot] in. You can also check their Contact Us page.

Include the screenshot you received from PostPe, where they said they cannot close your account.

Level 3: Escalate it to SBM Bank Grievance Redressal:

If SBM Bank customer support fails to resolve your query, you should quickly escalate the same to the SBM Bank grievance redressal portal.

Visit the SBM Bank Grievance Redressal website.

Please note, there are 3 Levels of Grievance Redressal. If you don’t get a satisfactory response from Level 1 within 10 working days, move to Level 2. If you don’t get a satisfactory response from Level 2 within 7 working days, move to Level 3. Hopefully, your account will be closed by now.

Level 4: RBI Ombudsman:

In case your Account closure request is not honored or you do not receive NOC even after requesting for the same, you can reach out to RBI Ombudsman for Grivance Redressal. Refer to my post: GUIDE: How to reach out RBI Ombudsman for Grievance Redressal?

Important Things to Remember:

Before you go ahead with closing your PostPe Pay Later Account, you should remember the following things:

- Double check if all your pending dues are cleared. Else it won’t be closed.

- You will get a NOC from your lending provider that your PostPe Pay Later is closed with no dues left. Ask for it if you don’t receive it within 2-3 weeks of requesting account closure.

- Sometimes (not every time), you may notice a slight decrease in your credit score after closing your account. Don’t worry, it is a temporary thing.

- It might take 2-3 months for the ‘closure’ to reflect on your CIBIL profile, so, don’t be scared if you find your PostPe Pay Later Loan ‘active’ on your CIBIL.

- Even after your PostPe Pay Later is closed, it will continue to display on your CIBIL as a ‘closed’ account, for a few years. It is just for record-keeping purposes (so that your future lenders know which credits you had opted for previously).

- Even if you don’t use it, there is absolutely no harm in keeping your PostPe Pay Later account as it is. It helps to keep a healthy mix of ‘Credit Card’ and ‘Loan’ accounts on your Credit Profile.

- If you do not own any credit cards till now, and have been offered PostPe Pay Later, consider keeping it active, since this is your first credit line. The age of a credit line has a high impact on your credit score. This might help you get a credit card or loan in the future when you need it.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.