What is the Control Number on your CIBIL? What does it signify? How to find your CIBIL Control Number? If these questions are on your mind then you have come to the right place. In today’s post, we will be talking about the CIBIL Control Number and how to locate the same on your CIBIL.

Okay, this query was first asked on our FinTalks OT Group (an Off-Topic Group of our FinTalks Facebook Group) by Sufiyan Shaikh.

He posted:

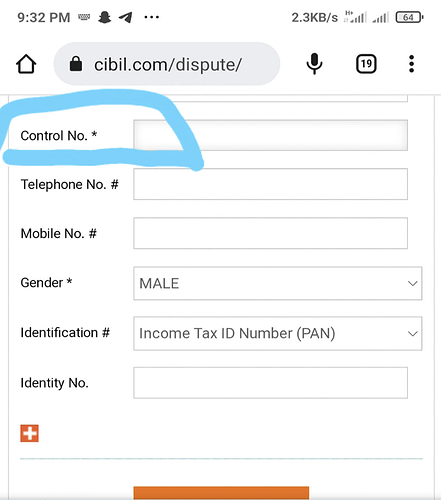

Hello guys, I’m trying to raise an issue in cibil and don’t know what to put in the control number. If anyone knows what to put, please help. Thanks.

What is the CIBIL Control Number?

Control Number is a 10 Digit Number that can be found in your CIBIL Report. Please note that Control Number can also be known as Enquiry Control Number or ECN.

What is the importance of the Control Number on your CIBIL?

A Control Number actually helps banks to access your Credit History via CIBIL. It basically allows the lender to know the details of the borrower.

This number is unique to every borrower. Every time a bank does a credit inquiry and pulls out your Credit Profile, a new control number will be generated and updated on your CIBIL. So, each Control Number can be mapped to each credit inquiry.

This is how the Credit Inquiries are arranged and managed in the CIBIL server. I hope this gives you a general idea of its importance.

How to Find your Control Number on your CIBIL Report?

First things first, to find the Control Number, you must know how to check your CIBIL Score. Refer to my post: How to Check My Credit Score for FREE? (CIBIL / Experian / CRIF / Equifax)

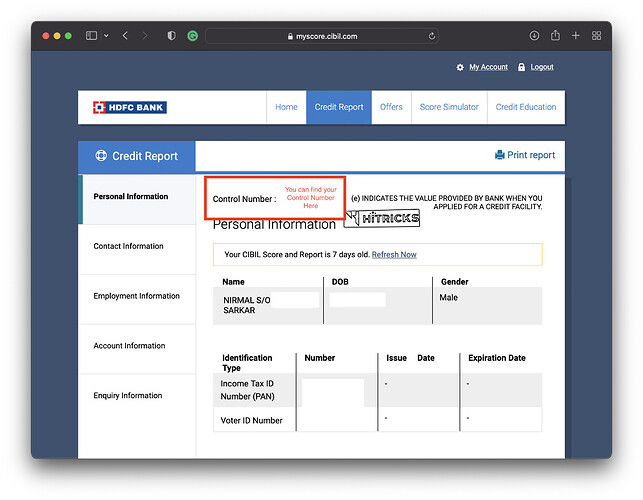

You need to Login into your CIBIL Portal. It can be a regular CIBIL portal or an HDFC CIBIL portal depending on which account you choose (read the above post I linked in the last paragraph, you will know).

Once you Log In, click on the Credit Report tab on top.

On that page, you can find your CIBIL Control Number at the very beginning of the page. It should show like this:

I hope now it is clear to you how you can find your Control Number on your CIBIL Profile. Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.