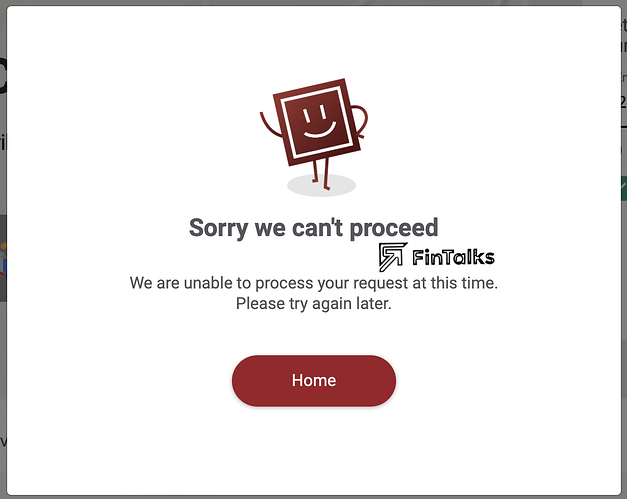

If you are someone who is facing this error while applying for IDFC First Credit Cards: “Sorry we can’t proceed - We are unable to process your request at this time. Please try again later”, then don’t worry, you are at the right place. Today, I will discuss the only verified method to resolve this IDFC First Bank Credit Card error. Keep reading.

This is the error message that gets displayed if you want to apply for an IDFC Credit Card after entering your Full Name and mobile number.

Already hold IDFC First Credit Card? Want to upgrade it to IDFC Wealth Credit Card? Refer to: GUIDE: How to upgrade your existing IDFC Credit Card to IDFC Wealth Credit Card?

Why this “Sorry we can’t proceed” error message comes?

Here are the possible reasons:

-

This is the most common reason: You have been declined an IDFC First Bank Credit Card recently (or a long time ago).

-

You have started your IDFC First Credit Card application sometime and then left in between.

-

You have closed an existing IDFC First Bank Credit Card.

-

You don’t know why: Probably you don’t recall applying for IDFC First Credit Card, however you are still facing this error.

No matter the reason, you will be able to fix the error if you follow these steps.

Important Points to Note:

-

If your IDFC First Credit Card application is declined recently then please wait for 6 months from the time of your decline message, and then try the method described below.

-

If you have closed your existing IDFC First Bank Credit Card, then please wait for 6 months from the time of your final card closure email, and then try the method described below.

How to solve the IDFC First Credit Card application error: Sorry you can’t proceed?

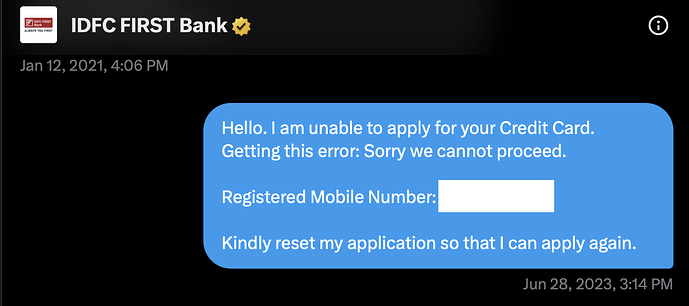

Contact IDFC First Bank support on social media. Mention your registered mobile number. Tell them your issue, attach a screenshot as a reference. Mention that you are facing this issue since .

Also mention that your last credit card application has been declined on , or you have closed your last IDFC Credit Card on , and it has been over 6 months since then.

Lastly, mention this: Kindly reset my application so that I can apply for IDFC Credit Card again. You can also mention them to cancel your old application as you want to apply fresh.

Here’s a sample message I sent them (I didn’t mention so many details, however it took me some time to get response, maybe you can get faster response if you give more details):

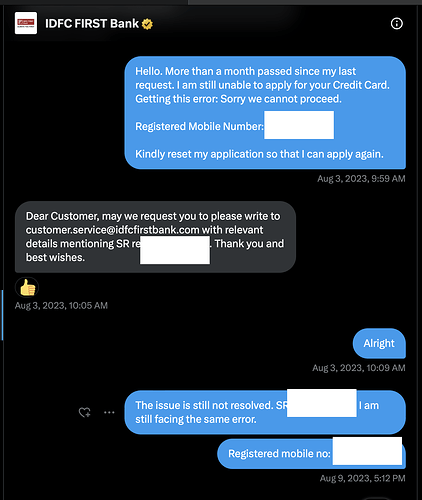

Now, wait for their response. They will call you and tell you that ‘You do not have any offer to apply for IDFC First Credit Card’. They might also share you a link via SMS to apply IDFC First Credit Card. However it is just a generic cc application link and won’t help you in resolving the error.

You have to tell them that you have waited for 6 months cooldown period already, kindly reset the application. 2-3 times repeated follow ups may be necessary.

Actually they have an IT team, and only them can manually remove the error for you. But usually they tell you to wait for 6 months or more. If you keep on following up, and say that your cooldown is over, then they will escalate this to IT team for the resolution.

Once the error is resolved, they will again call you to confirm it.

That’s all. Overall it may take over a month, since their followups take time. They might also tell you to mail them on their email. Do it, if they asks you.

For me it took almost 2 months… see the timestamps of the screenshot above and the screenshot below. Don’t be disappointed; good things take time.

I can confirm that this is the only valid method to resolve your IDFC First Credit Card application error: Sorry we cannot proceed.

Once the error is resolved, you can Apply for IDFC Credit Card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.