In case you are using Slice BNPL Card, there are urgent matters you need to see this RIGHT NOW! Also, please use Slice Card at your own risk. Without much fuss, let me explain the matter to you!

1. Slice Updated Terms of Product:

Slice has updated its Most Important Terms of Product, which you can read here. In case you don’t want to read the entire thing, here’s what you need to know:

Read this:

Each time the Customer utilises the slice card for undertaking a transaction, the relevant Financing Partner will sanction and disburse the loan, which will be used for loading the Customer’s slice card to undertake the said transaction.

What this means: Every time you transact with your Slice Card, a new Loan will be sanctioned against your name.

The specific terms of each of the loans disbursed by the Financing Partner will be set out in the sanction letter and loan agreement accessible on slice portal.

What this means: You can read the loan agreement and sanction letter on your Slice App against each transaction.

This is scary if Slice App starts issuing loans against each transaction, and you make say 30 transactions in a month, there will be 30 loans against your name! Just ridiculous!

2. I Reached out to Slice on Twitter:

I had tweeted to Slice asking for clarification in this regard. You can check out my tweet here. I request you to Retweet it also so that others can get aware.

https://twitter.com/HelloNirmal/status/1546384185434116096

3. Slice Replied to that Tweet (and Later Deleted that Tweet):

Slice Team responded to that Tweet:

@HelloNirmal Hi there, we understand your concern and would like to clarify that all your card transactions in a statement period will be reported as a single disbursement to credit bureaus. Please be rest assured that your credit score will not be impacted by this change. ^Vedik

And soon after, that reply Tweet was deleted. But thanks to Twitter user @indyan he could fetch the tweet. (Anyways, that tweet was a lie, coming to that later)

https://twitter.com/indyan/status/1546466717760495616

4. I got a Call from Slice Team:

Later on, I got a call from Slice Team, who explained the same thing to me as their tweet, that all my card transactions in a statement period will be reported as a single loan, so I need not worry.

I pointed out to them, that it was not what was written in their MITP, and either you rectify your MITP or you issue a statement addressing the same. They said, okay they are looking into it.

I wasn’t doubting them till that time and really wanted them to look into it. I also tweeted about my interaction with them.

https://twitter.com/HelloNirmal/status/1546459846878195715

https://twitter.com/HelloNirmal/status/1546459854432112640

5. And Here Comes the Lie.

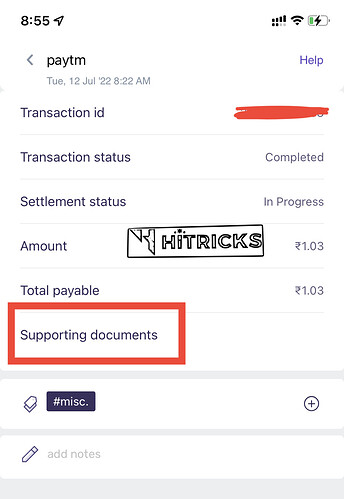

Although in my tweet I said that I won’t be using the Slice card until they address it, I took a risk to verify what they said. I added ₹1 to PayTM Wallet (they charge some extra fees for using Credit Card/BNPL Card, so I had to pay a net amount of ₹1.03) using my Slice Card.

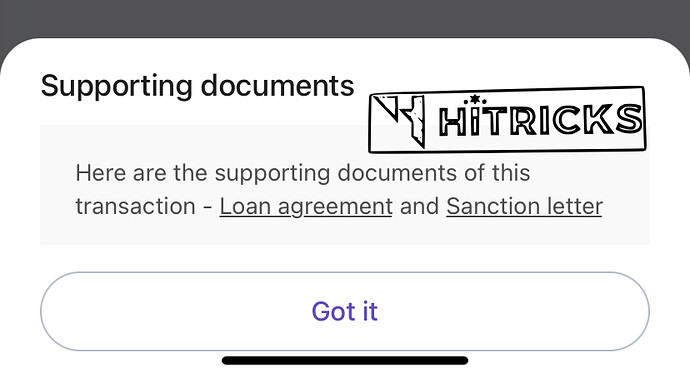

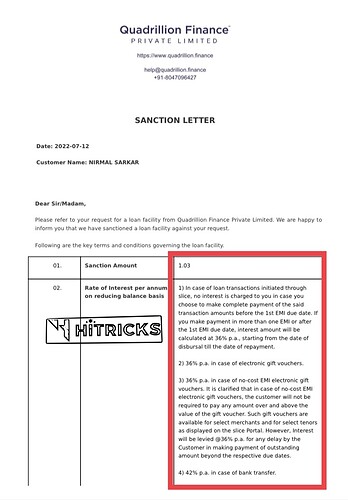

It had a section named ‘Supporting Documents’, I clicked on it, and there were two files: Loan Agreement & Sanction Letter.

And when I checked them out, it turned out to be true: They had issued a loan amount of ₹1.03 against my name. Good heavens!

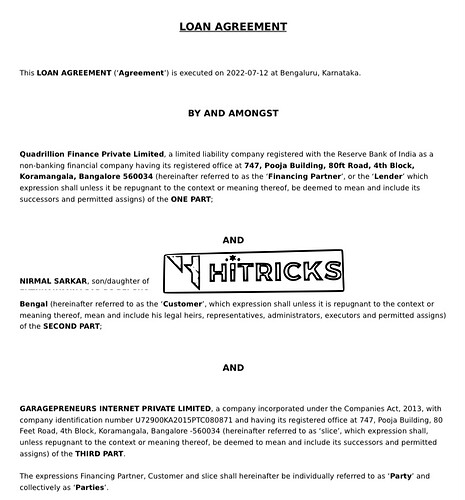

Here’s the first page of the Loan Agreement: (Notice the date, its when the transaction was done, and this will be unique for each day)

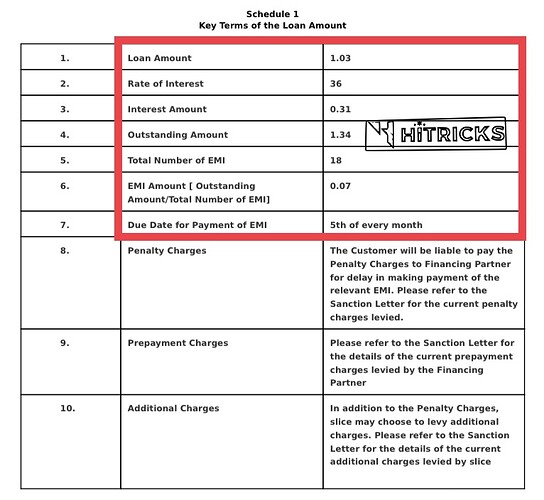

Here’s the Details of the Loan Sanctioned, as written in the Loan Agreement:

- Loan Amount: ₹1.03

- Rate of Interest: 36%

- Outstanding Amount: ₹1.34.

- EMI: 18 Months.

- EMI Amount: ₹0.07.

- Due Date: 5th of Every Month.

So, for each transaction you carry out with Slice, you will get a Loan Sanctioned under your name, like this, which was exactly what was written in their MITP.

By the way, you won’t be incurring interest if you pay your outstanding amount before the 1st Due Date. Only if you repay the loan in parts (EMI), you will incur interest. This is clarified in their Sanction Letter.

This is the first page of the sanction letter (above). I have uploaded the rest of the pages (except Page 1, which contains my personal details) on Dropbox. It contains their fees, and tax details. You can read it from here.

Last Words:

These were my findings. Now it is over to you. You decide how to go forward with this. You may seek further clarification in writing and then decide. It is totally up to you.

In case you have something more to share, feel free to comment below. You can easily register on our FinTalks forum and interact freely.

I will probably close my Slice Account. In case you want to close your Slice Account, you may refer to this post: GUIDE: How to Permanently close SlicePay Account?

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.