Checking your Credit Score Regularly is a very good habit since it allows you to detect mismatches in your Credit Report and dispute the same. Refer to: How to Check My Credit Score for FREE? (CIBIL / Experian / CRIF / Equifax)

Also, checking your Credit Score Regularly DOES NOT affect your credit score at all. Curiosity is good! Refer to: Factors that Affect your Credit Score Positively/Negatively

Although there are 6 credit bureaus in India, CIBIL is given the most importance since all major credit card and loan issuers refer to your CIBIL Score for determining your creditworthiness.

So, in case you find any mismatches in your CIBIL Score you can directly dispute it via CIBIL. In today’s post, I am going to show you the step-by-step guide for the same.

Types of Mismatches in CIBIL that can be Disputed:

- Unknown loans/credit cards in your CIBIL.

- Incorrect credit limit (or other information) in your CIBIL.

- Unkown Credit Enquiries in your CIBIL.

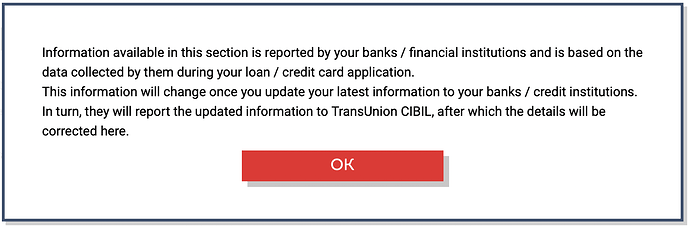

Note that CIBIL is merely a data collector and they won’t entertain any ‘changes’ that you request from your side. All data is fed by financial institutions, and to update your personal information according to your choice, you need to contact your bank/credit card issuer.

The CIBIL Dispute platform is only for detecting unknown or incorrect entries which are likely to be mistakes and affect your Credit Score.

How to Dispute your CIBIL Credit Score?

- Sign up / log in to your official CIBIL Dashboard. CIBIL Official Site | HDFC CIBIL Users.

- Click on 'Credit Report’ Tab on the Top. Scroll Down and click on ‘Raise a Dispute’ from the Footer section.

- A new Dispute Window will open. You can choose the items that you want to dispute.

- Finally, click on ‘Submit Dispute’.

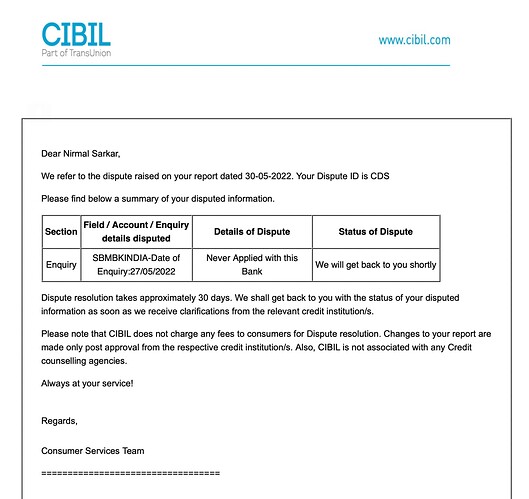

- Within an hour or so, you will get a email with the Confirmation of Dispute Received. Now wait for further updates/resolutions.

Possible CIBIL Dispute Resolutions:

Mostly CIBIL Dispute Resolutions are of 2 types:

- CIBIL will remove incorrect entries after verifying them with your bank.

- CIBIL will ask you to contact the bank to update your personal details and then CIBIL will update it.

Either way, you will know the status of your dispute and work accordingly. This is free of cost, and you should definitely try it out to keep your CIBIL Profile error-free.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.