AU Small Finance Bank is offering Lifetime Free Credit Cards to Salaried Employees. In today’s post, we will look at the details.

Eligibility Criteria for Lifetime Free Credit Card:

- You must be a salaried employee from the list of companies mentioned in this PDF:

- Download it from our FinTalks Forum. You must Sign up / Log in to this Forum, else it will show Page Not Found error.

- Download it from our FinTalks Facebook Group Post. You must join our Facebook Group.

-

In case you work on any other company which is NOT mentioned in this PDF, then you won’t be getting a Lifetime Free AU Credit Card.

-

In case you are self-employed, then you won’t be eligible for a Lifetime Free AU Credit Card.

-

Finally, not all locations are serviceable. For example, the entire city of Kolkata is non-serviceable for AU Credit Cards. You can check on their online portal whether your location will be serviceable or not.

How to Apply for AU Small Finance Bank Credit Card?

- Visit the AU Credit Card Application Portal. (Use Mobile Device, it won’t work on a PC)

- Enter your Mobile Number and PAN Card Number.

- Verify with OTP.

- Now you can sign in and enter your personal and employment details.

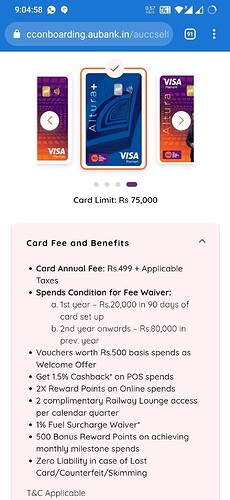

- Based on the same, you will be shown eligible Credit Cards. Choose the one you want to apply.

- Note that you won’t be shown Lifetime Free status here. You will see it as a Chargeable Card only. The Lifetime Free status needs to be manually confirmed after you receive your Card. More on that later.

- Once you select your card, you have to Proceed with Aadhaar KYC. It will select your Address from there. You can also choose any other delivery address. In case your location is unserviceable, it will show there.

- Submit your Application. That’s all.

- In most cases, the application is approved instantly and Card is generated. In some cases, it is taking a few days to approve. Some applications are getting declined too. You have to wait a few days to know the status.

- Once your application is approved, Contact AU Bank Support and confirm the Lifetime Free Status of your Card. Ask them if your Card is Lifetime Free or not. (Dial No, Navigate IVR: Press 6 > 9)

- If they say your card is issued as Lifetime Free, Enjoy.

- In case they say your card has not been issued as Lifetime Free, you need to mail AU Bank with your last 3 months’ Salary Slip, and your Office ID. Once it is verified, your card will be converted to Lifetime Free.

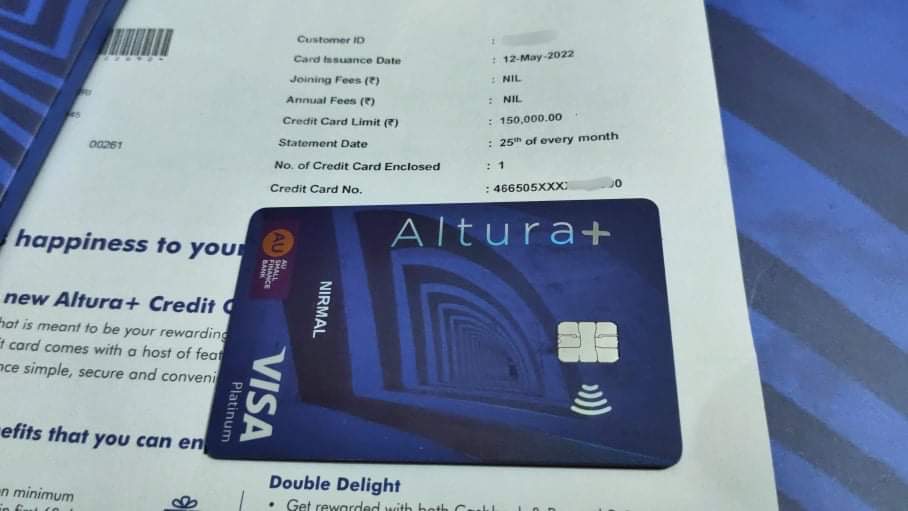

Another way to confirm is to wait for Card Delivery. For Lifetime Free Cards, the leaflet will be like this:

However, if it says paid, then you need to send documents like I said above.

Note: Make sure your company is listed in the PDF given above. If your company is not listed, you won’t be eligible for a Lifetime Free AU Bank Credit Card.

AU Credit Card Application FAQ:

Q: Are they doing Physical KYC or vKYC?

Ans: vKYC is being done. No physical KYC is needed. Some people are also getting instant approval without vKYC.

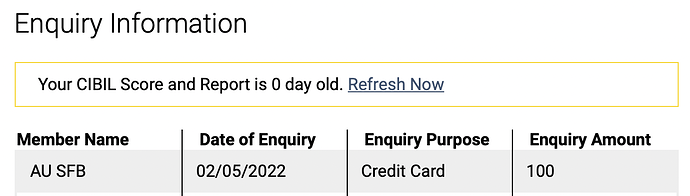

Q: Will my CIBIL Inquiry be Done?

Ans: AU Bank does Soft Inquiry of ₹100 only. It won’t impact your CIBIL Score at all.

Q: I have a Single Name. Can I apply?

Ans: You cannot apply online. You have to apply offline.

Q: My Application is Rejected, What is the Cooldown Period?

Ans: 6 Months for online application. However, you can apply offline via branch without any cooldown period.

Q: My KYC Information has issues and needs rectification. How do I reset it?

Ans: You have to visit AU Bank Branch for that. Same if your Aadhaar vs PAN Information does not match.

Q: Can I apply C2C using another Bank Credit Card Statement?

Ans: Not necessary. Income proof is not asked. Only KYC (Aadhaar and PAN) is needed.

To learn more, follow these FinTalks threads by Kapil Ahir and Sumit Gupta.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.