In case you want to apply for IDFC First Bank Credit Card, IDFC Wealth Credit Card is the best credit card that you can choose. It has no joining fee or annual fee. It comes with lots of perks, we will discuss them below.

IDFC First Wealth Credit Card Features:

- Earn 10 Reward Points per ₹100 spent on spending above ₹30000 per month, and on spends done on your birthday.

- Earn 6 Reward Points per ₹100 spent for spends up to ₹30000 per month online.

- Earn 3 Reward Points per ₹100 spent for spends up to ₹30000 per month offline.

- Redeem Reward Points on IDFC Portal at the rate 1 Reward Point = ₹0.25.

Note: Reward Points not applicable on Fuel, EMI Transactions and Cash Withdrawals. Rent payments will earn 3 Reward Points per ₹100 spent, and Insurance payments will earn 1 Reward Points per ₹100 spent. However, they won’t be calculated for the ₹30000 milestone spends per month. - Buy one Get one Movie Ticket up to ₹500, twice per month, on PayTM App.

- 4 Complimentary Domestic Lounge Access per quarter.

- 4 Complimentary International Lounge Access per quarter via Dreamfolks.

- 4 Complimentary Railway Lounge Access per quarter.

- 4 Complimentary Spa Visits per quarter.

- VISA Infinite Benefits like ₹300 BOGO on BMS, Times Prime Membership, and more.

- Lower forex markup fees of 1.5%.

- 2 Complimentary Golf Rounds per month on spends above ₹20000 per statement.

- Get Cancelation insurance up to ₹10000 for hotel and flight cancelations, for up to 2 claims per year.

- Get complimentary roadside assistance worth ₹1399.

- Get 1% Fuel Surcharge Waiver, up to ₹400 per month for spends between ₹200 and ₹5000.

- Get Air Accident Cover of ₹1 Crores, Personal Accident Cover of ₹1000000, and lost liability cover of ₹50000, Travel Insurance cover of USD 1200.

IDFC First Wealth Credit Card Joining Benefits:

- Get a welcome voucher of ₹500 on spending ₹5000 or more within 30 days of card issuance.

- Get 5% cashback up to ₹1000 on your first EMI transaction within 30 days of card issuance.

IDFC First Wealth Credit Card Charges:

IDFC First Wealth Credit Card is Lifetime Free. You don’t have to pay any joining fees or annual fees.

Important Points:

- You can apply for IDFC First Wealth Credit Card only if you have an existing credit card with a Credit Limit above 5L, or an annual income proof of above 36L to obtain this card.

- If you do not have an existing credit card with a Credit Limit above 5L, then you can also apply. You will get a lower variant card like IDFC Select Credit Card or IDFC Classic Credit Card. Don’t worry, you can always upgrade your IDFC Credit Card to Wealth after 6 months. Refer to: GUIDE: How to upgrade your existing IDFC Credit Card to IDFC Wealth Credit Card?

How to Apply for IDFC First Wealth Credit Card:

Apply IDFC First Wealth Credit Card from here. You will be asked some basic information to check your eligibility criteria before you are redirected to the bank website.

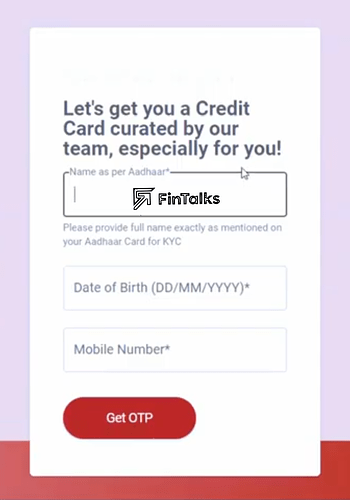

In the bank website, you will be asked to enter your Name, Mobile Number, and Date of Birth. Confirm Mobile Number via OTP.

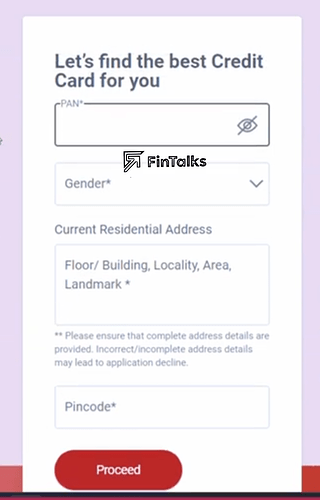

Next, enter your PAN number, Gender, Residential Address and Pincode. Click on Proceed.

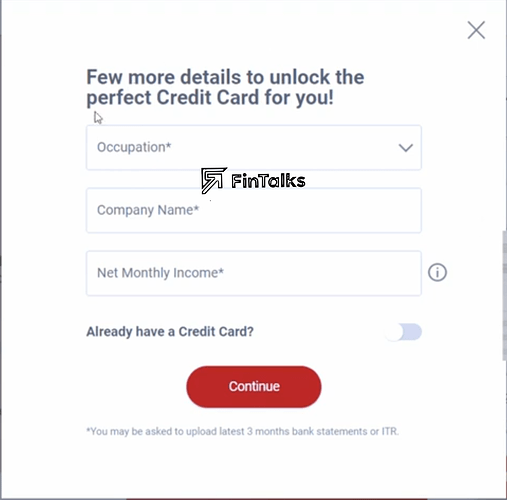

Finally, choose your Occupation (Salaried/Self Employed), Company Name, and Net Monthly Income. If you already have a Credit Card, turn the credit card slider on.

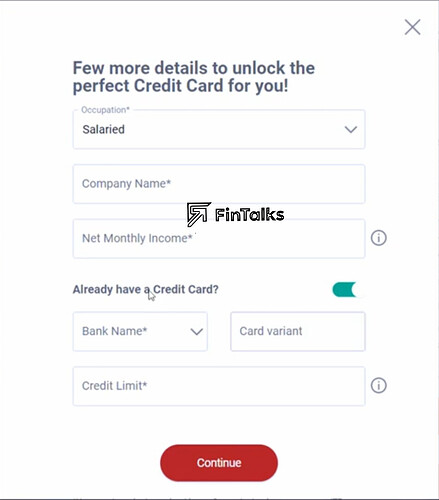

Choose your Credit Card provider bank name, Card variant, and Credit Limit of your existing credit card. Click on Continue.

Then wait for some time, it will show ‘Finding the Best Offer for You’.

Finally, IDFC First Bank will show you two credit cards to apply, based on your eligibility. You might see the words “No Income Proof required” or “Credit Card Statement Required” against your cards. You can apply any one from the list. Click on Get Your Card.

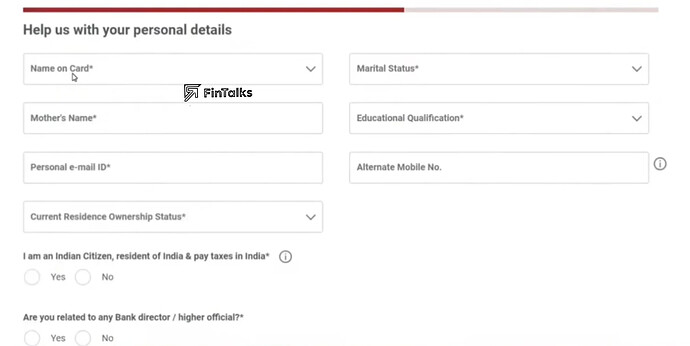

On the next page, you will be asked your personal details: Marital Status, Mother’s Name, Educational Qualification, Personal Email ID, etc. Fill them. Click on Proceed.

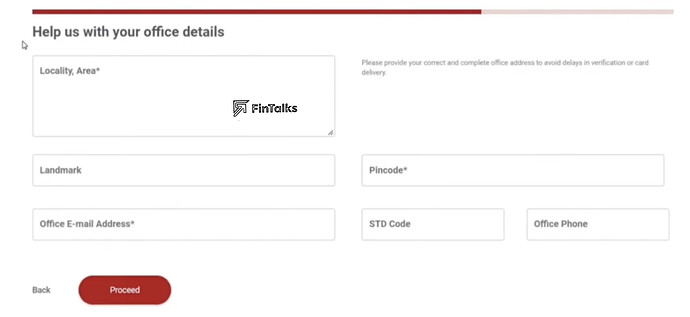

On the next page, you will be asked to enter your office details. Enter your Office Address, Landmark, Pincode, Office Email. Don’t worry, your office email won’t be verified. Click on Proceed.

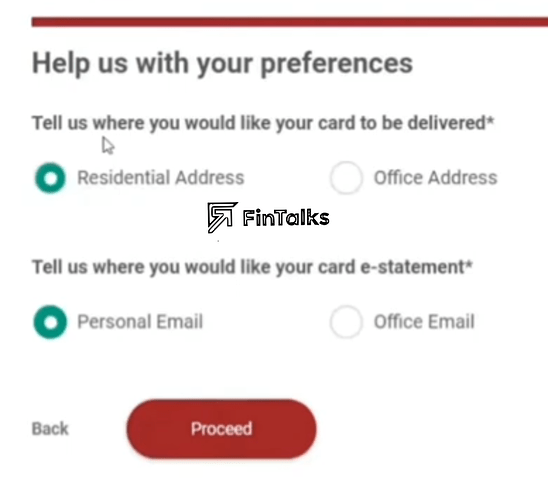

Next, you have to choose where you want your card to be delivered, and where to receive your IDFC Credit Card statements. Choose and click on Proceed.

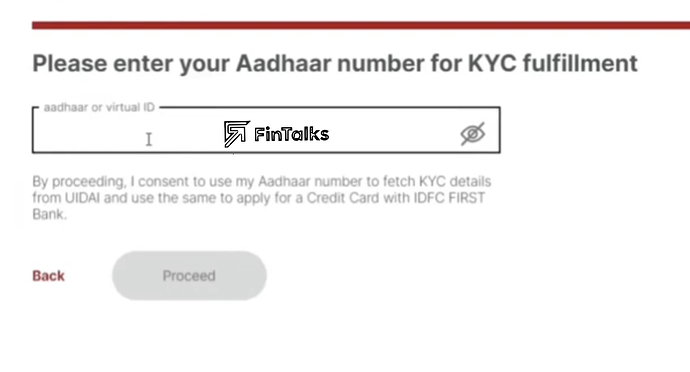

Now, you have to do eKYC via Aadhaar Card. Enter your Aadhaar Number, and verify via OTP.

You have to confirm your Aadhaar Address (just for records). Finally, you can submit your application. Next, you have to complete your Video KYC with your original PAN Card.

Once that is done, wait for 1-2 days. Usually, IDFC First Bank is quick to approve applications. You will get a verification call from IDFC First Bank. Attend it. Sometimes, they do home address verification, which can take another day. You can track your IDFC First Credit Card Application online.

Congratulations, you have successfully applied for the IDFC Wealth Credit Card.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.