Are you using a lot of credit cards? Want to track your monthly or annual usage of your credit card? Then download the ‘FinTalks Credit Card Planner’ today and get started easily.

What is FinTalks Credit Card Planner?

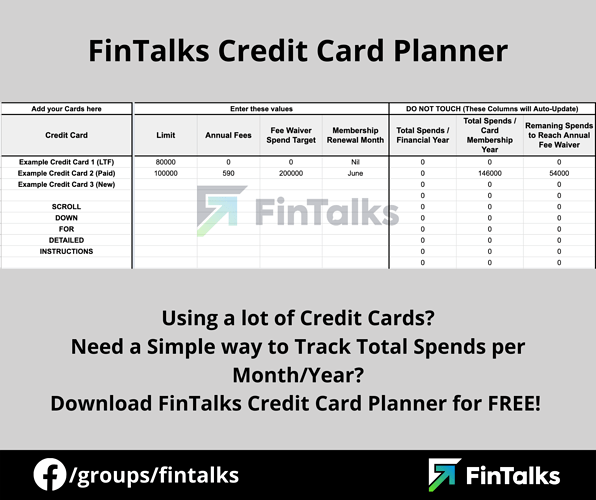

The idea behind the FinTalks Credit Card planner roots from my personal ‘excel sheet’, which I maintain to track my monthly/annual Credit Card spending. It is nothing but a chart containing my monthly spending, in an easily readable manner. There is nothing ‘complex’ or ‘special’ about it.

However, I find a lot of people asking for Credit Card spends tracker, so I decided to put my tiny Excel Sheet up online for you guys. You can download the template and start filling up your Credit Card information. It will work for you.

The fact is, you can prepare it on your own also, I am just spoonfeeding you.

Features of FinTalks Credit Card Planner:

Okay first things first, this is called ‘planner’ and not ‘tracker’ as it doesn’t automatically ‘track’ anything unless and until you enter any data manually. Simply put, it doesn’t ask for any sensitive information. It will chew on whatever you feed it.

Here’s the data you can check with the help of this:

- Your Credit Card Monthly/Annual Spends.

- Your Cumulative Credit Card Monthly/Annual Spends across all Cards.

- Check the Bill Generation Date and Due Dates for each Credit Card.

- Check the Annual Membership Renewal Month for each Credit Card.

- Check the Remaining spends needed to reach an Annual Fee Waiver against your Credit Cards.

For now, I am only including these data in the initial release. As we go forward, I may be adding more data in the future versions, as and when needed.

Download the FinTalks Credit Card Planner:

Note: The download link is restricted to ‘Members-only’. To Download the FinTalks Credit Card Planner you need to Sign Up / Log in to our Forum first.

Click this link to Download the FinTalks Credit Card Planner. (Sign up / Log in to FinTalks Forum to Download it, else you will see this error: Oops! That page doesn’t exist or is private)

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.