For those who want to open an Axis Bank Savings Account, I will definitely suggest going for the Axis Liberty Account, it comes with some additional benefits and rewards compared to the regular Easy Access Savings Account.

Even if you have an existing Axis Bank Savings Account, consider upgrading to Axis Liberty Account.

In today’s post, I am going to talk about Axis Liberty Account in detail.

Features of Axis Liberty Account:

There are basically 3 highlighting features which is why I absolutely love this account:

- Flexibility: Either maintain 25k MAB or spend 25k per month with zero MAB.

- Rewards: Earn 5% cashback on Weekends with Axis Liberty Debit Card.

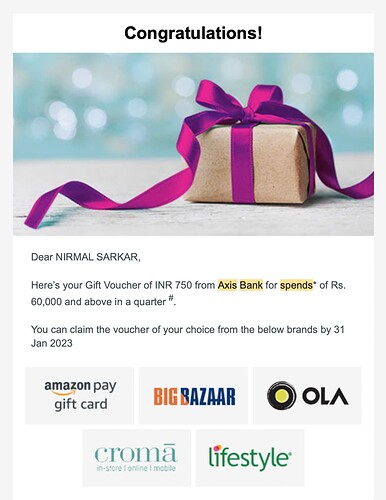

- Milestone: Earn a Quarterly Gift Voucher of ₹750, on spending ₹60000 in each quarter. That’s ₹3000 in a year, much more value back than anything else. I have written a detailed guide on How to Redeem Axis Liberty ₹750 Quarterly Gift Voucher?

- Also get unlimited free NEFT & RTGS transactions.

Axis Liberty Account MAB/Spends Criteria:

- You can keep 25k MAB or 3L FD.

- Semi-Urban & Rural Areas: 15k MAB required only.

(OR) - You can spend 25k every month from your Account. No MAB Requirement in that particular month.

- Note: Spends include merchant payments from your account using Debit Card, Internet Banking, and Merchant UPI. Regular P2P transactions won’t count towards spending.

Axis Liberty Debit Card:

- With your Axis Liberty Account, you will get Axis Liberty Debit Card. Joining fees ₹200. Renewal fees ₹300 per year. No fees for Liberty Salary Account.

- Daily ATM Withdrawal Limit of ₹50000, and Daily Purchase Limit of ₹300000.

- Earn 5% Cashback on spends across Food, Entertainment, Shopping, and Travel category spends every Saturday & Sunday. No minimum transaction necessary.

- Maximum Cashback ₹500 per month on all months.

- Maximum Cashback ₹1000 on birthday month.

- 1 Complimentary Lounge Access per quarter at Domestic Airports. (Only available for Liberty Salary Account holders, not available for Liberty Savings Account)

- Personal Accident Insurance Cover of up to 5 Lakhs.

- Air Accident Insurance Cover of up to 1 Crore.

- Earn 1 Edge Reward point every ₹200 transaction.

- Axis Bank Dining Delights Offer: up to 20% off on select restaurants.

Axis Liberty Account Milestone Rewards:

- Spend ₹60000 in a Financial Quarter and Earn ₹750 Gift Voucher.

- Spends with Debit Card, Internet Banking and UPI Merchants will be counted. Paying Credit Card Bills via Cred UPI also counts (I verified it personally).

- You can choose Gift Voucher from Amazon, Big Bazaar, Ola, Croma, Lifestyle, and Zomato Gold.

- You will earn ₹750 Gift Voucher every quarter.

How to Apply for Axis Liberty Savings Account?

- For New Customers: Click here to request a Callback. You can also visit your nearest Axis Bank branch.

- For Existing Customers: You need to visit your nearest Axis Bank branch and request for account upgrade.

- Please carry your Original Aadhaar & PAN Card while visiting your bank. You need to fill up a form (both for new account openings and existing account upgrades)

- For new accounts, you will get your Account Opening Kit delivered to your home. For account upgrades, only your Account type will be changed. Your existing old Debit Card will continue to work. If you want to upgrade your Debit Card to Liberty, you must manually upgrade it from your Axis Mobile App or Internet Banking.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.