Freecharge Pay Later is a BNPL (Buy Now Pay Later) service offered by Axis Bank via the Freecharge App. They offer an upfront credit line, that you can use every month.

In case you are looking to open an account on Freecharge Pay Later, I think you should reconsider. In my opinion, it is best to avoid the service altogether. I have tried out the Freecharge Pay Later service for the last 2 months, and am sharing the details below.

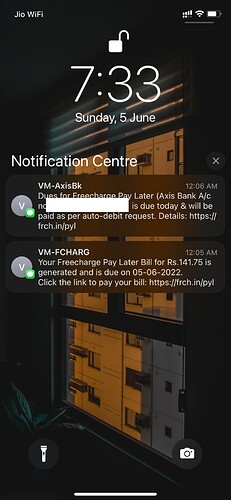

Reason 1: Your Bill Generation Date & Due Date is the SAME!!!

This is the most frustrating part. Freecharge generates the bill for me on the 5th of every month. The due date is also on the same day! If I somehow miss paying the bill that day, it will be marked as a ‘late payment’ on my Credit Report, and bring down my Credit Score.

Typically, a Credit Card gives you around 3 weeks’ time from the bill generation date to pay your bills. Other BNPL services still give you 5-10 days to pay your bills, however, Freecharge expects you to pay up on the bill generation date itself.

Reason 2: No Email Statement / Alerts:

Generally, Credit Cards send you a monthly email statement where you can view all your transactions in one place. There are apps like CRED or INDMoney that notify you about your credit card statement over Whatsapp, so you never miss payments.

Several BNPL services like PayTM Postpaid or OlaMoney Postpaid send you monthly bills over email so that you can take a look. But in the case of Freecharge Pay Later, you only get SMS alerts! No Email alerts at all.

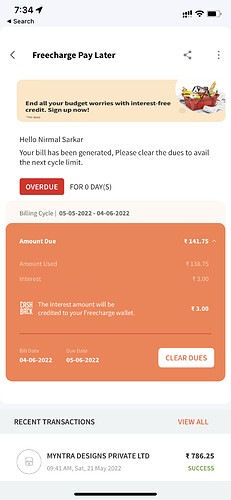

Reason 3: You are charged Interest just for Using the service!

You sign up for Freecharge Pay Later and get a credit line. But, if you use it, you will be charged interest on the same. Currently, they are charging around 2% Interest.

I had spent an amount of ₹138.75. They billed me ₹141.75.

Currently, they are giving back the interest amount as cashback in your Freecharge Wallet. So, you need to spend some more amount with your Freecharge Wallet to utilize your cashback.

Reason 4: You cannot Pay your Bills upfront:

This is the most irritating part. Since you know your billing date is your due date, you may want to clear your dues upfront. Freecharge Pay Later doesn’t allow you to do so! You have to wait till the bill generation date.

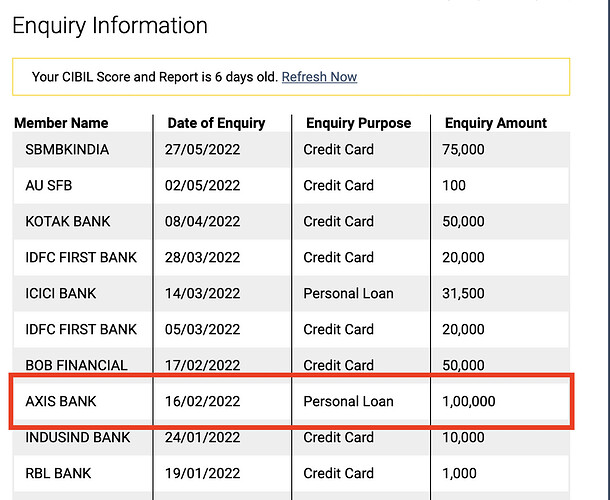

Reason 5: Get a Hard Inquiry of ₹100000 on your CIBIL:

If you apply for Freecharge Pay Later, Axis Bank will do a Hard Inquiry of 1 Lakh on your CIBIL! Let that sink in. I have applied for a lot of credit cards and faced a lot of hard inquiries, however, in most cases, the inquiry amount is on the lower side (₹100 - ₹1000 - ₹10000). Only CITI Bank did a 1 Lakh Hard Inquiry in my entire Credit Card journey. The other one is Axis Bank for Freecharge Pay Later.

Btw, those who don’t know about Hard Inquiries & Soft Inquiries and how it affects credit score, check my other post: Hard Inquiry vs Soft Inquiry Explained: Will it affect Credit Score?

How to Close Freecharge Pay Later?

So, in the end, it is in the best interest of all, don’t apply for a Freecharge Pay Later account. It will be a complete headache for you. If you have already applied for Freecharge Pay Later and haven’t used yet, please don’t think of using it.

In case you want to close your Freecharge Pay Later Account, follow this post: GUIDE: How to Permanently Close Freecharge Pay Later Service?

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.