Good News! State Bank of India (SBI) has finally started a 100% online account opening process for Regular Savings Account to encourage online banking.

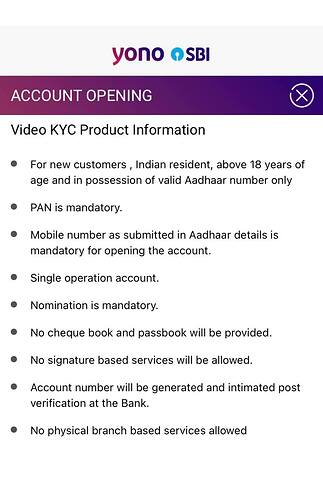

Earlier, you could open an account online via YONO Application, but you needed to visit your nearest SBI Branch within 6 months to complete the full KYC. But since the last week of April 2021, the entire customer onboarding process is fully online.

SBI Insta Plus Savings Account:

- MAB Requirement: ₹0.

- Initial Funding: ₹0.

- Rupay Debit Card Charges: ₹150 + GST Annually. (Not confirmed though, I will update once this is verified. In case you have any updates do comment below and let us know.)

Features:

- Internet Banking, Mobile Banking via Yono App, and Phonebanking services.

- SBI Missed Call service and SMS Alerts.

- No cheque book and passbook will be provided. You can request it from the bank later if needed.

- No bank branch-based physical services will be provided.

- Get Consolidated Account Statement on your email.

How to Apply?

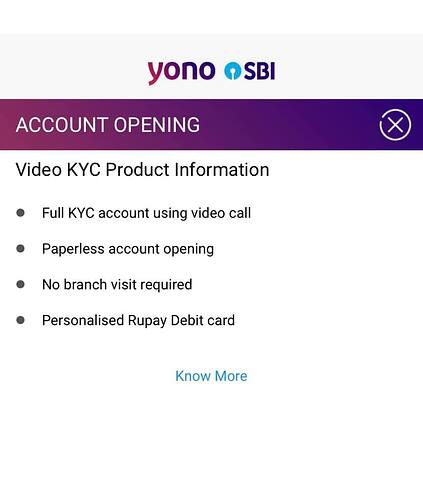

You can open a new SBI Savings Account in a fully contactless method without visiting the branch. It is facilitated by Video KYC via Yono App.

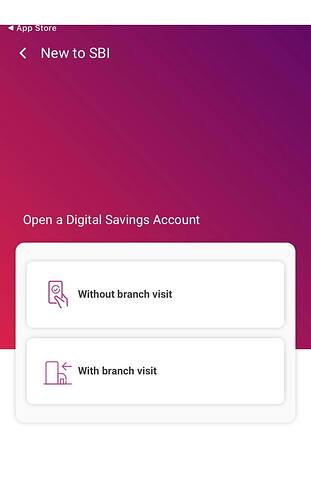

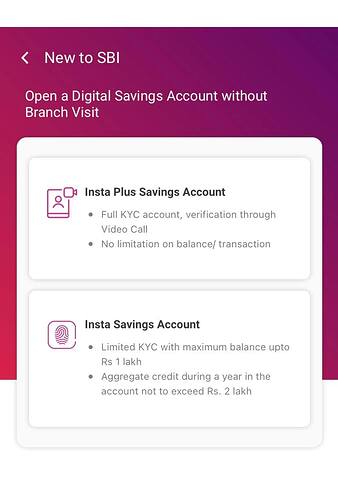

To avail of this new facility, you need to download and install the YONO App (or apply online via the link given below), then click on ‘New to SBI’, and select ‘Insta Plus Savings Account’.

You will have to enter their Aadhaar details in the app and once the Aadhar authentication is complete you will have to input personal details and schedule a video call to complete the KYC process.

On successful completion of Video KYC, the account will be automatically opened without having to visit the bank branch. You will get the account opening kit by courier.

You can either apply online or use the Yono SBI App.

You will need your Aadhar Number and PAN Card (Original) for VKYC. Your account kit with debit card and cheque book will be delivered to your registered address within 2 weeks.

For more details, follow this thread on our FinTalks Facebook Group.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.