Rupeek is a FinTech Startup that provides Gold Loan right from your doorstep or your nearest bank branch. They have launched a payment card, called Rupeek Prime, that provides you with digital credits instead of a Direct Loan, which you can use anytime for any kind of payment.

At launch, this is available in 30 cities in India, with more being added gradually.

Benefits of Rupeek Prime Gold Card:

The main benefit of the Rupeek Gold-powered card is up to 45 days of the interest-free period, just like a credit card. So, traditionally speaking, if you take a Gold Loan, you will be charged interest on your loan amount from Day 1.

However, in the case of Rupeek, you get an upfront credit for the Gold you safe keep with them, and you can use it anywhere. If you pay bills and clear your dues on time, you won’t be charged any interest.

So, this translates to an interest-free Gold Loan, that you can use partially, for the amount you need.

Think of this as a secured credit card, where you get a credit limit based on your Fixed Deposit, only that here the collateral is Gold.

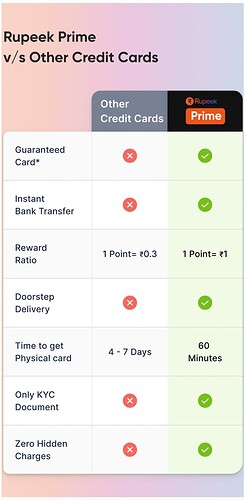

Features of Rupeek Prime Gold Card:

- Available at your Doorstep. No need to take your Gold to someplace elsewhere.

- Up to 45 Days of Interest-free period.

- Money Transfer from your Gold Card to Bank Account at 0% Interest.

- Free Gold Locker with 100% Insurance.

- Earn Reward Points on Every Transaction you do with your Rupeek Prime Gold Card.

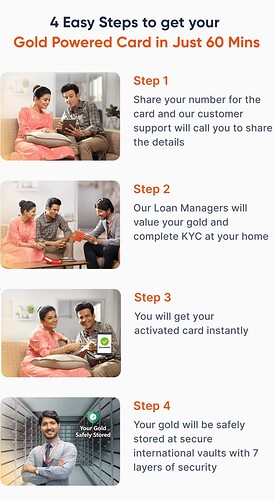

How to Apply for Rupeek Prime Gold Card?

Visit the Rupeek Prime Gold Card website and enter your details. You will receive a callback from them on the same day.

Rupeek Loan Managers will come to your home and value your Gold, and complete your KYC then and there. Your Gold will be stored at secure vaults with Rupeek.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.