Disclaimer: The material herein is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

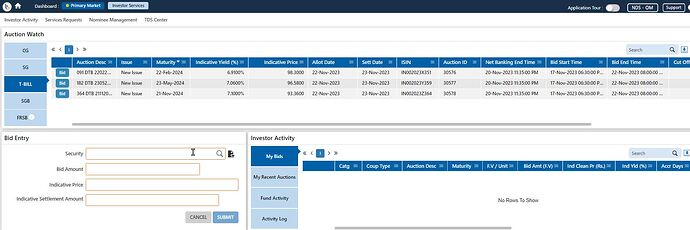

If you have funds lying around in your savings account which you do not intend to use in the short term (90D or 180D), a better option is to park it with RBI - The bankers bank. Enter RBI Retail Direct - A platform to directly invest with RBI in short-term T-Bills (91D, 182D, 364D), Bonds, Floating-Rate Notes, G-Secs, etc. Registration process is very simple and online and you can directly link your bank account for deposits and withdrawals. T-Bills are available for investment every Friday after 6:00 p.m. and you can fund your T-Bill using UPI, Net Banking or NACH (National Automatic Clearing House) mandate .The minimum amount you can invest is 10K and in multiples of 1K.

Do note that unlike regular FDs, you get the interest upfront as a discount and this is directly credited to you bank account after investment and upon maturity you will get your principal back (Obviously without any interest ![]() ).

).

.

RBI Retail Direct Website : https://rbiretaildirect.org.in/#/

(As of 21-Nov-23)

| Tenor | YTM | ICICI FD Rates |

|---|---|---|

| 91D | 6.9374 | 4.7500 |

| 182D | 7.0987 | 4.7500 |

| 364D | 7.1297 | 6.0000 |