This was posted by Ashwani Arora on 31st March 2021 on our FinTalks Facebook Group. I added some parts to make it comprehensive.

As you know linking Aadhar Card with your PAN Card is now mandatory. The last date for completing the same is 30th June 2021, as per the latest Income Tax Notification.

Here are two methods how you can do it:

Prerequisites:

- Your Aadhar Card needs to be linked with your Mobile No.

- Your Aadhar Card name should match exactly your PAN Card Name. Even a space difference would be treated as a mismatch and the linking process will fail. (In that case, visit your local Aadhar enrollment center and get your name corrected, or apply for a corrected PAN Card online).

Method 1: Via Income Tax India e-Filing Official Website

Visit the Income Tax e-Filing Official Website for linking PAN Card: Click Here.

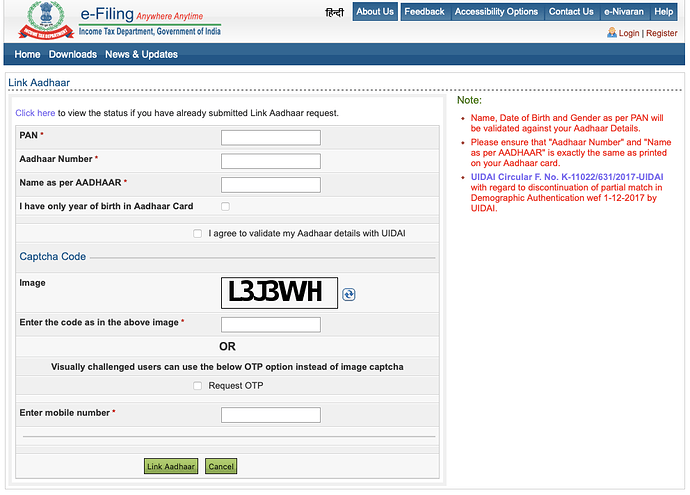

You will find this:

Enter your PAN No, Aadhar No, and Name as per Aadhar in the designated fields. You need to validate your details with UIDAAI in the next step. Follow the instructions and you can do it very easily.

Method 2: Via SMS

Those who are facing problem in Pan and Aadhar linking on incometaxindiaefiling.gov.in as the site does not work properly many times can try this SMS method:

You can also link your Aadhar with a PAN card by sending an SMS to 567678 or 56161 from your registered mobile number. Type UIDPAN and click send.

The format for the SMS is: Type UIDPAN (12-digit Aadhaar number), put space (10-digit PAN), and send it to 567678 or 56161.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.