This information was shared by Ashwani Arora on our FinTalks Facebook Community on 17th November 2021.

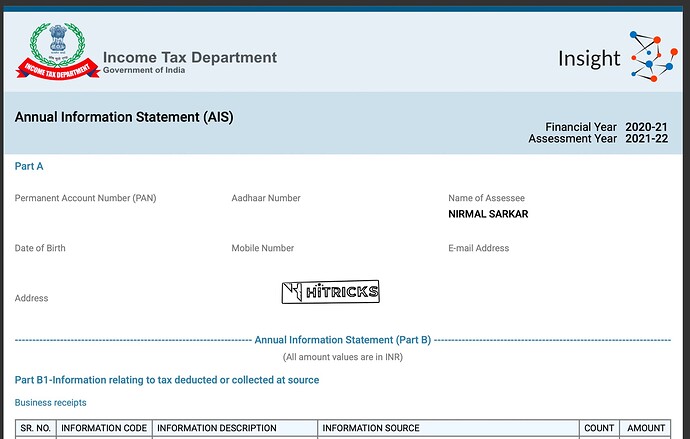

Income Tax Department has announced the roll-out of a new statement - AIS (Annual Information Statement).

This will give you all details (well almost all!) about YOUR financial transactions during the year.

What is AIS (Annual Information Statement)?

You know earlier Income Tax used to give statement 26AS.

AIS is a much detailed one - with many more details included - like your Savings Interest, all Mutual Fund transactions during the year, etc. Here’s the list of transactions to be reported in AIS.

Will 26AS be stopped?

a) Now you can get both 26AS and also AIS.

b) Both put together, the Income Tax department knows all your financial transactions.

c) And it’s good as now you will find it very easy to know and submit details for your Income Tax returns.

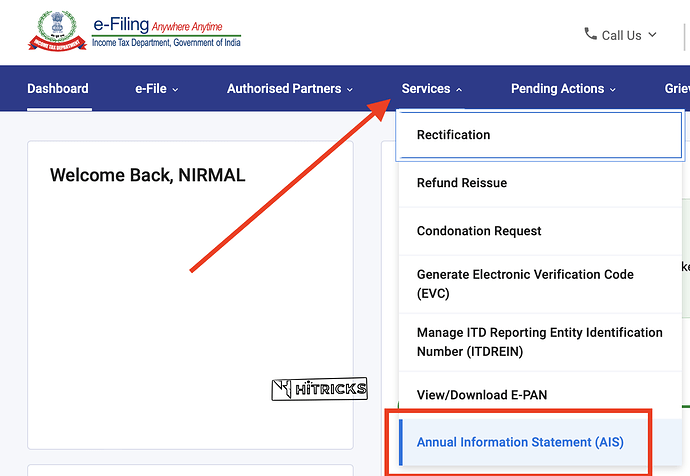

How to access my AIS?

a) Log in to your Income Tax Online account.

b) Go to Services Tab.

c) Last option in this tab is the AIS option.

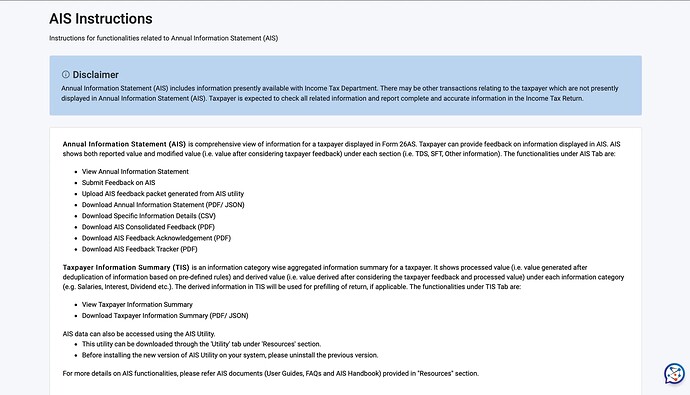

It will open a new tab with an AIS Instructions Tab:

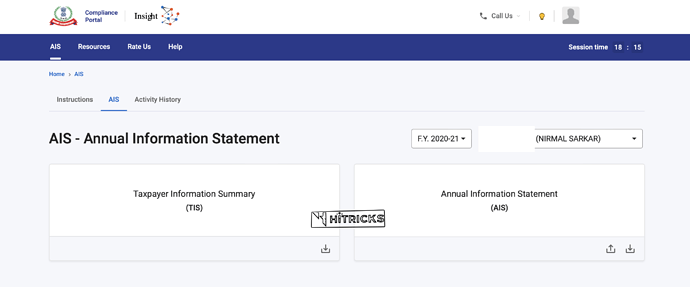

Click on the Next Tab named ‘AIS’. You will find the following two options:

a) Left side - Tax Information Summary (TIS)

b) Right side - AIS

Both are the same. TIS is a summary and AIS is the detailed statement. You can download both. When you download you get a pdf statement. (There is a jpeg option also)

PDF will be password protected. Password is your PAN Number (in CAPITAL) + Date of Birth (DDMMYYYY)

AIS will capture all financial transactions of the previous year.

a) Stocks

b) Insurance

c) Credit Cards

d) Purchase of property

e) Mutual Funds

f) Salary or Business income

g) Dividends

h) Interest in SB A/c and Deposits.

The above list is just indicative. It is your overall financial profile and will be getting fine-tuned to include more categories.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.