Are you an absolute beginner in Term Insurance? Want to know how you can choose the best insurance for you? You are at the right place.

This was originally posted by Priyanshu Ranjan on 21st August 2020 on our FinTalks Facebook Group.

People often assume that buying term life insurance burns a hole in our pockets and it’s the reason that despite being the purest form of insurance, the penetration of Term Insurance is so low in India.

Remember, term insurance is NOT an investment instrument! It aims to provide financial security for you and your family. It ensures financial assistance for your dependants in case of an unfortunate event.

Being said that, let’s go through some things which need to be looked at before buying term insurance:

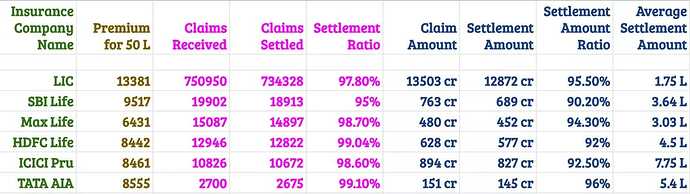

Settlement Ratio: claims settled/total claims received by the company. Higher claim settled means better insurance (right?).

Now, for almost 95% of people, the research is over. People assume that a company with a higher settlement ratio is better!

Premise: Higher Claim settlement ratio doesn’t always mean better term insurance.

Example: Suppose a company XYZ receives 100 claims, out of which 99 claims are of insurance like ULIPS, endowment plans, money back schemes, etc and 1 claim is of term insurance. if the company settles 99 claims and rejects 1 (term life) claim, then the ratio will be 99%! Hence, the claim settlement ratio is not a distinctive measure to study term insurance.

What should we look at?

-

Settlement Amount Ratio which indicates the ratio of amount settled. A higher Settlement Amount Ratio indicates a higher settlement for term insurance.

-

Average Settlement Amount (higher average settlement amount indicates more term insurance getting settled).

You can look at the excel screenshot attached (compiled on IRDAI data).

[Note: This data is as of August 2020].

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.