This post is taken from our FinTalks Facebook Group. Credits to Prince Kumar.

Kotak811 Launched A Premium Savings Account For Everyone With Guaranteed 5% Cashback

Kotak 811 Super Savings Account offers a range of attractive features, especially for those who want a premium banking experience.

(Picture Credits: FinTalks Member Subhajit Maparu)

Kotak 811 Super Savings Account Benefits:

-

5% Cashback on Debit Card Spends: You can earn up to ₹500 per month in cashback (up to ₹6,000 annually) on your debit card purchases. This applies to both virtual and physical debit card transactions like online shopping or point-of-sale (POS) payments.

-

Platinum Debit Card : This account comes with a Super Platinum Debit Card that has a daily transaction limit of ₹3,00,000 and an ATM withdrawal limit of ₹1,00,000. It also includes multiple insurance benefits, such as personal accident coverage, air accident insurance, and lost card liability.

-

Zero Balance Requirement : There’s no need to maintain a minimum balance. However, to qualify for cashback, you need to credit at least ₹5,000 into your account each month.

-

Additional Perks : The account offers a zero-cost chequebook with 25 leaves per year and access to dedicated customer support through the Kotak811 mobile app.

There is an annual subscription fee of ₹300 for these premium features, and the account will be valid for one year, after which you can opt to continue. You need to deposit ₹5000 per month in the account to be eligible for these benefits. If you miss the deposit, your Super status will remain until 1 year, however you won’t be getting any cashback.

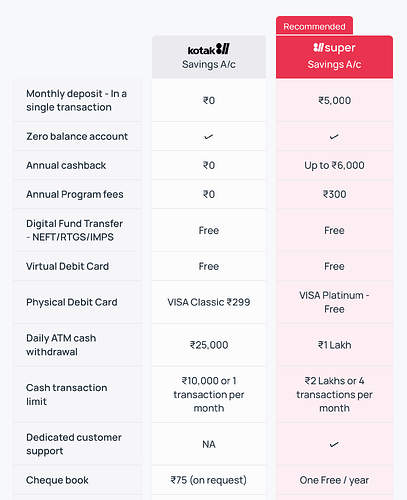

Here’s a comparison between Kotak 811 Savings Account and 811 Super Savings Account:

Click here to Open Kotak 811 Super Savings Account. If you have an existing Kotak 811 Savings account, you can upgrade to Kotak 811 Super Savings account from above.

Once you open your Kotak 811 Super Savings Account and use for some months, you can proceed to Apply for the Kotak League Platinum Credit Card Lifetime Free and get it pre-approved.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.