Did you know that credit cards are issued for spending on your personal or dependent family members only? Many of us use our credit cards for purchasing for our friends or relatives due to exclusive offers tied up to our cards, EMIs, etc.

However, you should keep in mind that the spending you do in a year with your credit cards can be reported to the Income Tax Department by your bank. In today’s article, we will discuss this Credit Card spending report in ITR in detail and tell you how you can access the same.

Let’s get started!

Credit Card Spends Report in ITR: What is the Rule?

The Income Tax department has asked financial institutions to report credit card payments beyond 1L in cash deposit, or beyond 10L in any other modes the Annual Information Statement in the Income Tax Portal.

Before it creates confusion, Iet me break it down:

- This rule applies each financial year, that is, from 1st April of a year to 31st March of the subsequent year, irrespective of your card membership or card statement.

- This rule applies to Credit Card payments that you do: 1L via Cash Deposit is reported, and 10L via any other modes is reported.

- This rule applies to each bank separately. So, if you have 3 credit cards from 3 different banks, say, Axis, ICICI, and HDFC Bank, and you have spends less than 10L in each card separately in a financial year, then it won’t be reported to Income Tax Portal.

- The upper limit is 10L per bank, and not per credit card. So, if you hold 3 credit cards from say Axis Bank, and your total cumulative spends across all 3 cards are less than 10L in a financial year, it won’t be reported to Income Tax Portal.

- In case your spends cross 10L per bank and is reported to Income Tax Portal, you should definitely file your Income Tax Return.

Examples of Credit Card spendings:

Case 1: 9L spends in Axis CC, and 9L spends in HDFC CC.

Result: It won’t be reported to Income Tax Department.

Case 2: 4L spends in Axis CC 1, 3L spends in Axis CC 2, and 3L spends in Axis CC 3.

Result: Axis will report this to Income Tax Department.

Case 3: 4L spends in Axis CC 1, 3L spends in Axis CC 2, 7L spends in HDFC CC 1, 4L spends in HDFC CC 2.

Result: HDFC will report this to Income Tax Department, and Axis won’t report anything.

I hope you get the idea. In case you have more confusion, then do comment below. I will be happy to help.

Things to Keep in Mind:

- Firstly, this is just a report. It does not necessarily mean you are doing something wrong. Many people spend more than that amount every month. And for good reasons.

- The issue arises when you use your credit card to purchase goods for others or do manufactured spending to collect reward points, leading to higher spending than you would normally do.

- The main problem is when you have credit card spending reported that is higher than your declared income. Suppose you declared your income as 6 LPA. However, if you have spent on your credit card reported 12 Lakhs, then Income Tax might ask you to justify how you did your spending.

- Also, in many cases, students are issued credit cards when they literally have no income. That is pretty common, and Income Tax Department has no issues with it. Because there is a 10L spending bar, which ensures that even if someone is using credit cards who has no income or very less income, they can do so up to 10L without issues.

How to check if your bank has reported your Credit Card spends in your ITR?

- Log in to your Income Tax Portal.

- Click on the AIS tab on top.

- Click Proceed on the popup.

- On the AIS page, you will see 2 Tabs: Instructions & AIS. Click on AIS.

- Again you will see 2 boxes: Taxpayer Information Summary (TIS) & Annual Information Statement (AIS). Click on AIS.

- It will load your AIS. Browse to Part B and click on SFT information tab.

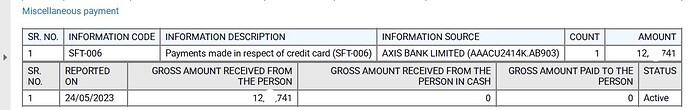

- Look out for this Information code: SFT-006: Payment for credit card. This tab will show whether or not any banks have reported your Credit Card spends, and also show the amount.

For example, refer to the image below. This will show up if you have any Credit Card spends:

Image Credits: Technofino.

FAQ:

Q: I found out that my credit card spends is reported in my AIS; however, I do not file ITR, or my ITR amount is lesser than my credit card spends. What to do? Should I be worried?

Ans: Consult a good CA immediately who can justify your spending somehow. Tell them all the truth why and how you did those spending on your Credit Card. Don’t get scared. That won’t help.

Q: I found out that my credit card spends is reported in my AIS; however, I haven’t received any notice from the Income Tax Department. What to do? Should I be worried?

Ans: Income Tax Department can send a notice for the current financial year for up to 7 years later. You should be prepared to justify your spending. So, the best thing is to consult a CA as soon as possible.

Q: I do heavy spends (beyond 10L) with my Debit Card/UPI. Will I face problems?

Ans: No. Debit card spends or UPI spends are not reported to ITR. However, you should not do Cash Deposits to your savings account beyond 10L, or else it will be reported.

In case you have further queries, do comment below. I will be happy to help.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.