In case you are using an IDFC First Bank Credit Card then you can easily apply for Addon Credit Cards for your family members. Here’s a step-by-step guide for the same.

What is Add-on Credit Card?

An Add-on Card is a secondary card provided to your direct family members. It is of the same variant as the primary card and shares the same features as the primary card. I have already written a detailed post on What is Addon Credit Card, what are its benefits. Check it out: Add-on Credit Cards Explained: Features, Benefits, How to Apply?

Things to Remember:

- A primary cardholder can apply for up to 3 Add-on Credit Cards.

- There are no charges for applying for add-on cards. They are issued as Lifetime Free Cards.

- The process is fully online, no paperwork is necessary.

- Important: IDFC First Bank will do vKYC of Addon Cardholder.

How to Apply for IDFC Addon Credit Card?

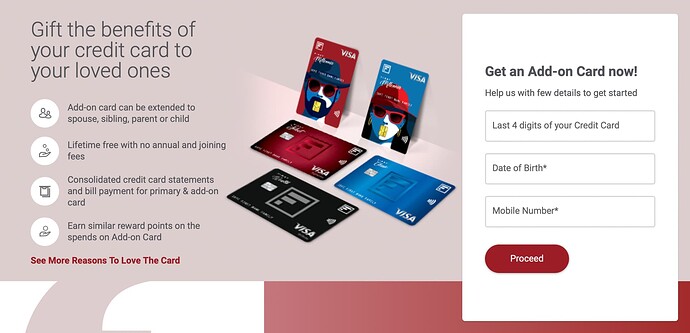

- Visit the IDFC Addon Credit Card Application Portal.

- Log in with your Credit Card Number (last 4 digits), Mobile Number, and Date of Birth.

- Inside, you will be asked to enter Addon Cardholder Details such as Name, Date of Birth, Relationship with Primary Cardholder, PAN, etc.

- You also need to upload KYC documents like PAN (mandatory) and Aadhaar Card (or any other address proof).

- Finally after submitting application you will get notification for scheduling vKYC for Addon Cardholder.

- Addon Cardholder needs to complete vKYC by showing their PAN Card, and signing on a white paper.

- That’s all. Your Addon Card will be processed within 48 hours and will be despatched to the registered address of the primary cardholder.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.