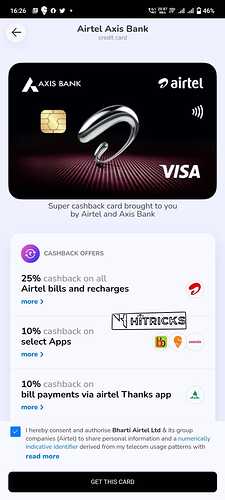

Axis Bank has tied up with Airtel to offer a co-branded Credit Card, called Airtel Axis Bank Credit Card. They have partnered with VISA as their payment processor.

Airtel Axis Bank Credit Card Features:

- Payment Processor: VISA.

- Get 25% Cashback on Airtel Mobile, Broadband, WiFi & DTH Bill Payments via Airtel Thanks App.

- Get 10% Cashback on utility bill payments such as Electricity, Gas, etc., via Airtel Thanks App.

- Maximum Cashback from the above 2 Categories via Airtel Thanks App is ₹300 per month.

- Get 10% Cashback on BigBasket, Zomato & Swiggy. Maximum Cashback ₹500 per month.

- Get 1% Cashback on all other spends with your Airtel Axis Bank Credit Card.

- Cashback will be credited to your card directly before next month’s statement generation.

- Get 1% Fuel Surcharge Waiver.

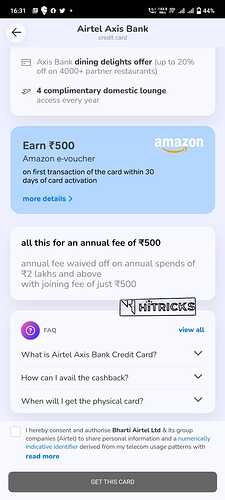

- Get Complimentary Lounge Access at Domestic Airports 4 times a year.

- Welcome Benefit: Get ₹500 Amazon Gift Voucher after your first credit card transaction.

For Detailed Terms and Conditions of Airtel Axis Bank Credit Card, click here.

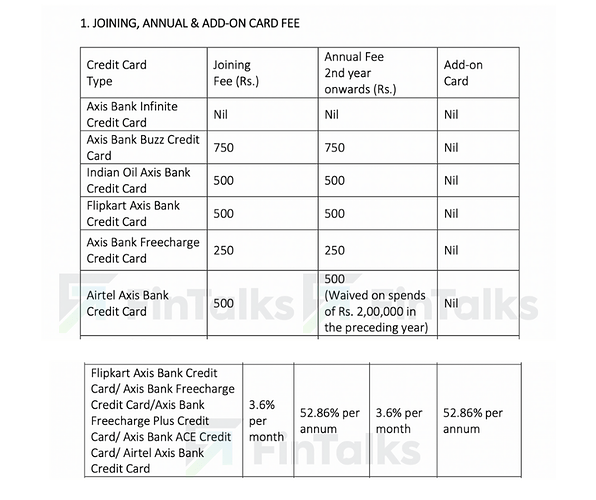

Airtel Axis Bank Credit Card Fees:

- Joining Fee: ₹500.

- Annual Fee: ₹500.

- Get Annual Fee waived off if you spend 2 Lakhs in the previous year.

- Add-on Card Fee: Nil.

- Monthly Interest Charges: 3.6%.

From what we understand, this card will be similar to the Flipkart Axis Bank Credit Card, and the Axis Bank Ace Credit Card, which are primarily cashback credit cards.

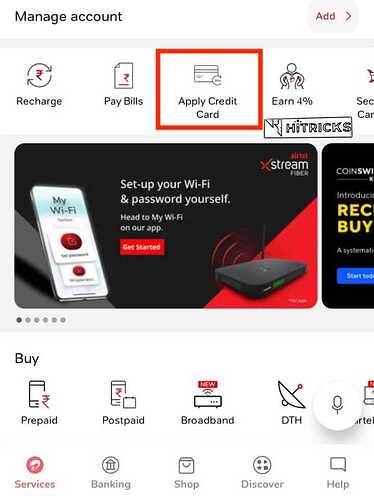

How to Apply for Airtel Axis Bank Credit Card?

At this moment, you can only apply for Airtel Axis Bank Credit Card via the Airtel Thanks App.

Open your Airtel Thanks App, you will find this option ‘Apply Credit Card’. You can apply it from there. Note that this option may not be available for everyone, kindly wait if it is not showing for you yet.

There is no news regarding whether you can upgrade your existing credit card to Airtel Axis Bank Credit Card. You can also try asking for this card upgrade by calling Axis Bank customer support and tell us if it works!

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.