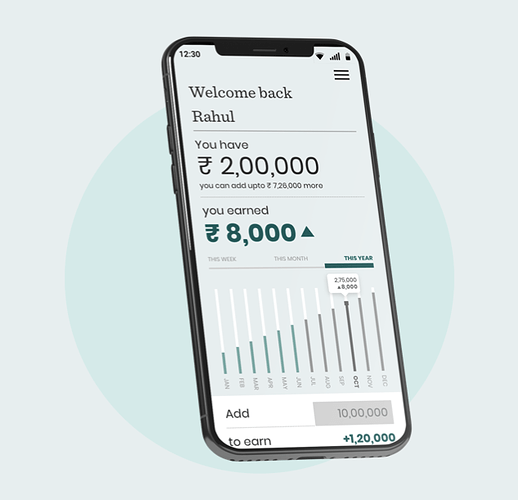

12% Club is an app powered by BharatPe that allows you to earn money through P2P Money Lending. You can earn 12% Interest per annum via this scheme. Also, the interest earned is credited every day, so you don’t need to wait for 1 year.

How does 12% Club App work?

The working principle of this 12% Club app is similar to Cred Mint.

We deposit our money with banks and other financial institutions. They offer us Fixed deposits and other schemes to grow our idle money. They use this money to offer upfront credits (via credit cards), loans, and other products and earn interest on that. This is a win-win situation for both us and the banks, where they earn from putting our money into the market and giving us a marginal interest while keeping the lion’s share for themselves.

P2P Lending has one major difference from traditional banking: Here there is no third party (financial institution) involved between you (the lender) and the one accepting the loan (the borrower). Basically, you become the bank here.

RBI has a list of registered P2P Lending platforms, 12% Club is one of them. You can either invest your money into the app or take a loan from someone else from within the app. The rate of interest remains the same for both: 12%.

The interest is charged daily and will be taken away from the borrower’s account and deposited into the lender’s account.

You can invest or withdraw your money with one click. It will be deposited into your bank account in one go.

Is this Trusted?

There are a few things I want to clarify:

When we are talking about the ‘trust factor’, we are essentially looking at two things:

- Whether the platform (12% Club App) is itself trusted and whether my money invested on this platform has any security?

- Whether the loans that are given out to the potential borrowers via this app is safe?

For 1:

- The 12% Club App is powered by BharatPe, which is a highly popular UPI app for merchants.

- It has a P2P NBFC partner LenDenClub and Liquiloans, both fully regulated by RBI.

For 2:

- The credit profile of the borrower is checked, and only those who have a strong credit profile, and have regular repayments, are considered for loans.

- This app is designed to replace the traditional offline P2P loans that we give out to neighbors, friends, or relatives which are often given on the basis of trust, and with no legal obligations. Compared to that, this app provides a structured framework.

Now, none of these are fail-proof, which brings us to the next heading, the risk factor!

What are the Risks?

Since now you know the working principle, you might be wondering what are the risks involved?

There are, in fact, quite some:

-

Your principal amount is itself being given out as a loan. In many other forms of investments, the returns are not guaranteed, however, you can recover most of your principal amount. But here, your principal amount is itself into the risk. You do get daily interest, but as long as your principal stays invested, it is in the red zone.

-

There is no hard and fast way of finding out defaulters. If your money borrower turns out a defaulter, LenDenClub and Liquiloan will try their best to recover the money out of them and keep following up with them. However, that’s all!

But the daily interest and the high rate of interest are lucrative for anyone who wants to try them out.

How to apply for a 12% Club Account?

Thank you for reading. Follow this thread on FinTalks Facebook Group.

Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.