HDFC Bank offers 5 types of Savings Accounts for Regular Individuals including Regular Savings Banking and High Networth Banking. In today’s post, we will be looking at the different HDFC Savings Account Tiers. In case you want to upgrade your existing HDFC Savings Account, check this post: How to upgrade HDFC Basic Savings Account to Classic / Preferred / Imperia Account?.

Some parts of this post were originally posted by Mahesh Goud on our FinTalks Facebook Group.

UPDATE 5th April 2022: HDFC Bank has added another tier of high networth banking: HDFC Infiniti. It is an invite-only program, only available to people maintaining a total relationship value of 5 Crores or more. Check the link to know more: HDFC Infiniti Banking Savings Account All Details

HDFC Online Savings Account Types:

- Regular Savings Account.

- SavingsMax Account.

- HDFC Classic Savings Account.

- HDFC Preferred Savings Account.

- HDFC Imperia Savings Account.

1 & 2 are regular Savings Accounts while 3, 4, & 5 are part of their high net worth banking program.

HDFC Savings Account Details:

| Details | Savings | SavingsMax | Classic | Preferred | Imperia |

|---|---|---|---|---|---|

| Eligibility | 10k MAB Urban, 5k MAB Semi-Urban, 2.5k MAB Rural | 25k MAB | 1L MAB / 5L TRV | 2L MAB / 15L TRV | 10L MAB / 30L TRV |

| Balance Non-Maintenance Charges | Applicable | Applicable | Nil, Downgrade | Nil, Downgrade | Nil, Downgrade |

| Debit Card | Millennia | Easyshop Platinum | Easyshop Platinum Classic | Easyshop Platinum Preferred | Easyshop Platinum Imperia |

| Debit Card Fees | ₹590 | Nil | Nil | Nil | Nil |

| Free ATM Withdrawals | HDFC: 5; non-HDFC: 3 in Metros, 5 in non-Metros | Unlimited | Unlimited | Unlimited | Unlimited |

| Free Insurance | No | Yes | Yes | Yes | Yes |

| Locker Rates for the First Locker | Normal | 50% Discount for the 1st Year only | 25% Discount forever | 50% Discount forever | 100% Discount forever |

| IMPS Charges | Applicable | Applicable | Applicable | Nil | Nil |

| Charges on other Banking Facilities | Applicable | Applicable | Nil | Nil | Nil |

| Off on Loan Processing Fees | Nil | Nil | 50% | 50% | 50% |

I have already discussed the HDFC Savings Account types and their features in detail. Check out this FinTalks Group thread, and this blog post below.

In case you want to upgrade your existing HDFC Savings Account, check this post: How to upgrade HDFC Basic Savings Account to Classic / Preferred / Imperia Account?

How to Open a Fully Online HDFC Savings Account?

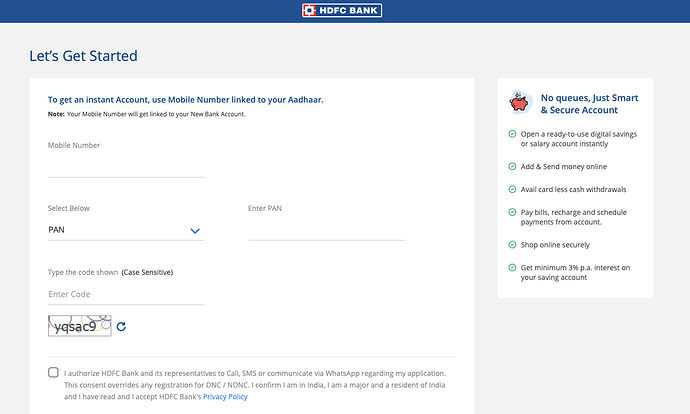

Click this Official Link to visit the HDFC Bank InstaAccount Website. You will need your Aadhar Linked Mobile Number and PAN Card Number. No physical document submission necessary.

- After 48hrs of video KYC, your account will get Activated.

- Once Activated you will get a welcome letter to your residential address in the next 4-10 days

- After that, you will get the welcome kit (Debit card, cheque book, passbook) (5-10 working days)

- You need not apply for any of these manually.

- HDFC won’t send any email or sms regarding the delivery of the welcome kit other than the Courier sms that contains a tracking number.

I will be updating this post with more information as necessary. Meanwhile, you should definitely check out this Important Bank Account Information.

Thank you for reading. Don’t forget to join our FinTalks Facebook Group & FinTalks Telegram Channel for regular updates on banking and finance.